- Online payment forms can save time and reduce errors associated with manual data entry.

- They can improve cash flow by enabling faster payment processing and reducing invoicing and collection times.

- Online payment forms can increase customer satisfaction by providing a convenient and secure way to pay.

- Integrating online payment forms with your website can streamline the checkout process and reduce cart abandonment.

📝Key Takeaways:

Digital payment is growing and starting to become a must-have service for businesses to offer. According to the MarketsAndMarkets report, the global digital payment market is projected to expand at a rising CAGR of 15.4% and reach $180.2 billion by 2026.

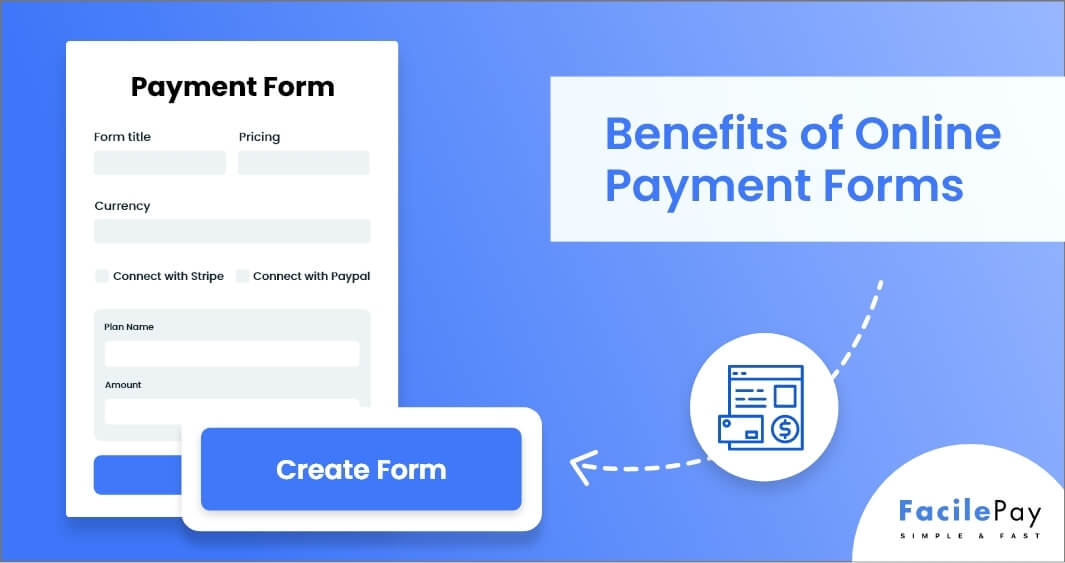

One digital payment system that is standing out in the market is the online payment form. It helps to streamline your payment process by providing a secure and convenient payment experience to your customers.

By implementing online payment forms, businesses can accept payments from customers anytime and anywhere. Let’s look at the 7 benefits of the online payment form.

Contents

The Risk of Ignoring Online Payment Forms: 4 Common Challenges

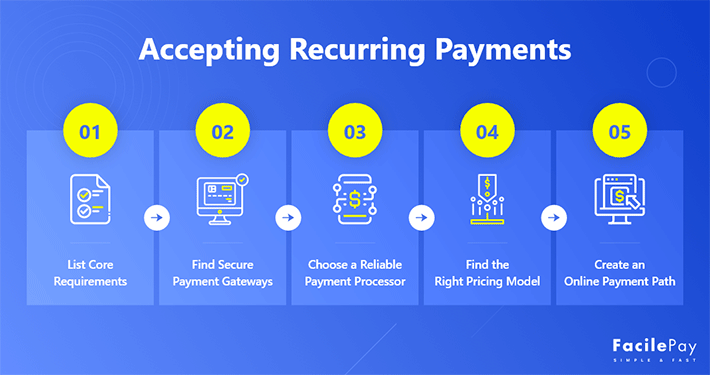

Are you still stuck with the traditional payment method? Switch to digital payments and create a customized online payment form for your users.

Before that, let’s take a look at the challenges of not using an online payment form.

1. Increase Workload for Business

By not using online payment forms, businesses have to follow a manual process which is time-consuming and involves a high risk of errors. It becomes tedious for employees to visit different payment methods to make one payment.

Also, it leads to decreased efficiency and productivity, as employees have to spend most of their time on administrative tasks. As a result, they do not get enough time to focus on other important business operations.

2. Risk of Data Security

One of the biggest concerns every customer would face is data security. By providing them with safe and secure online payment methods through digital forms, it becomes easy to retain customers and build trust

Security risks such as fraud worry customers because it gets difficult to recover that money. Thus, without secure online payment, businesses risk exposing the sensitive information of customers to hacking.

3. Difficult to Track Recurring or One-Time Payments

Following the traditional payment method will lead you to pile up paperwork resulting in difficulty to track. Moreover, it becomes challenging as you may fetch low accuracy while generating reports.

Furthermore, it becomes harder for businesses to make informed decisions based on inaccurate reports. With online payment forms, you get time to analyze data accurately.

4. Decrease Opportunity to Reach Customers

Every business has a competitive market and you cannot afford to lose any customers because of shifting to digitization. By not offering digital payments, your business seems outdated and less competitive.

Customers compare businesses and will choose a convenient method to make payments. Moreover, this will lead to down profitability and market share as customers are likely to choose businesses that offer better payment experiences.

Additionally, it will affect your business reputation and credibility. Therefore, giving efficient online payment options to customers has become an essential factor for businesses.

However, every challenge has a solution, and below are the answers to it.

7 Benefits of Online Payment Form

Here are the top 7 benefits of using online payment form that help businesses to overcome every challenge.

1. Allows Flexibility for Customers to Make Online Payments

Online payment forms enhance customers’ experience with flexibility by allowing them to make online payments anywhere and anytime. The customer has levels of accessibility and convenience to perform online transactions.

Also, online payments save them from waiting in a long queue to complete their payment or reaching a physical location to make the payment. Moreover, customers do not have to waste time trying to resolve payment issues or jumping multiple pages to pay online.

Thus, the online payment system helps increase customer satisfaction and build loyalty toward your business. Additionally, it is beneficial for businesses whose customers are located in different time zones, or who have busy schedules to make payments in person.

2. Acquire More Customers and Increase Sales

Offering an effortless online payment form will make a massive impact on your sales and customer acquisition. Customers will choose electronic payments where they will be able to complete the payment process rapidly and hassle-free.

Moreover, online payment forms are integrated with PayPal and Stripe; along with the use of credit and debit cards for payment services. By offering a streamlined electronic payment system, you are making it easier for your customers to make purchases or do payments, no matter what method they choose for payments.

Also, it will help you reach a wider audience and increase the overall sales of a business as your customer will pick an uncomplicated payment method.

3. Save Time and Eliminate Manual Work

Online payment forms automate the payment process which reduces the time and effort required for the payment process. It eliminates manual data entry and manual payment processing, which was time-consuming and prone to errors.

Implementing online payment forms is effortless as customer information is already there and allows you to enter or edit information as per required. It decreases the risk of minor errors and with editing, you can change the information in a minute and receive payment instantly.

As a result, you have valuable time to focus on business and administrative tasks, and it does not take much time to accept online payments. Furthermore, by automating the process, the chances of late or missed payments are reduced.

4. Improve Cash Flow by Accepting Payments Instantly

Online payment forms help you to improve your cash flow with quick payment processing. As you receive payment immediately, instead of waiting for checks to clear or getting paid through the traditional methods.

In the manual payment process, you have to carry cash or deposit money to your bank account, but online payment forms streamline your process by offering online payments.

Moreover, online payment forms allow you to automatically collect money and avoid chasing after customers for late payments. By improving your cash flow, you have more flexibility and stability to invest in your business and make it more successful.

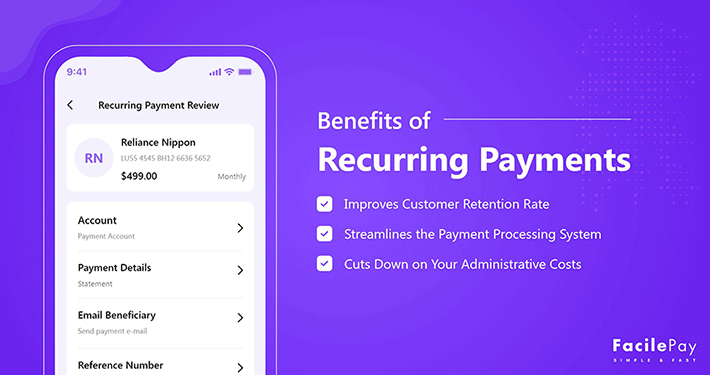

5. Minimize Delayed Payments or Reminders

Many businesses are unable to grow because they spend more time on follow-up rather than collecting money. By using online payment forms, you have access to easy setup automated reminders and notifications for customers with overdue payments.

Moreover, setting automated reminders helps to ensure that payments are received on time. So, you acquire recurring payments instead of consuming hours or days on follow-ups for due payments. It also decreases unnecessary time and improves the overall cash flow of your business.

It is very useful for small businesses as they have to perform multi task all by themselves and do not have time for follow-ups. Furthermore, with a record of payment details and tracking, you have a better understanding of payment status which allows you to make better decisions for your business.

6. Enhance Data Security and Encryption

As mentioned earlier, data security is essential for every business. By offering online payment forms, you secure encryption that protects sensitive customer information, such as billing addresses and credit card details.

By implementing encryption, you are ensuring that customer information is protected from hacking or access to unauthorized systems. Moreover, it decreases the risk of fraud and data breaches and gives peace of mind to you and your customers.

Additionally, by using a secure online payment form, you are reducing the risk of disputes and chargebacks for violating customer information. Also, you develop loyalty as you safeguard the data and meet the industry standards by following compliance for data security.

7. Efficient Way to Accept Quick Payments

Acquiring a payment gateway is the ultimate goal for businesses. By using online payment forms, you are providing a fast and efficient platform to make seamless payment transactions. You are offering customers to make payments in just a few clicks.

By implementing online payment forms, you ease subscription market operation and make recurring payment capabilities efficient. With online payment forms, you do not have to make customers wait in line or on calls. Moreover, it helps increase customer satisfaction.

Additionally, you will be able to manage reports and track payment status. It helps businesses to increase customer engagement and make insightful research from it.

Frequently Asked Questions

-

How do online payment forms help my business save money?

By using online payment forms, you are able to reduce the cost associated with labor, manual payment processes, bank fees, and the cost of paper checks. Moreover, automated processes help you save time which leads to investing in work that is important for your business.

-

Can online payment forms be customized to fit business needs?

Yes, online payment forms can be customized as per business requirements. It includes a logo, color change, and specific details. For instance, if you want a form for donation, you add information and customize it as per needs

-

What are the benefits of accepting multiple payment methods through online payment forms?

When the card is present, contactless cards receive the same interchange rate as soon as the card is inserted into the reader. Contactless cards will not have higher fees than other card types and will also receive similar interchange rates when the card is not present.

Choose Online Payment Forms to Accept Payments Seamlessly

Online payment forms are easy-to-use payment methods that can be performed anywhere and anytime. It is beneficial for both businesses and their customers as it helps to save efforts with instant payment processing.

Moreover, it helps to drive growth, increase cash flow, and improve customer satisfaction by offering simple payment processes in one place. It reduces the proneness of errors because of the available information in it.

Overall, it is a valuable investment for the business to streamline its payment process by offering a quick, convenient, and secure payment process for businesses.