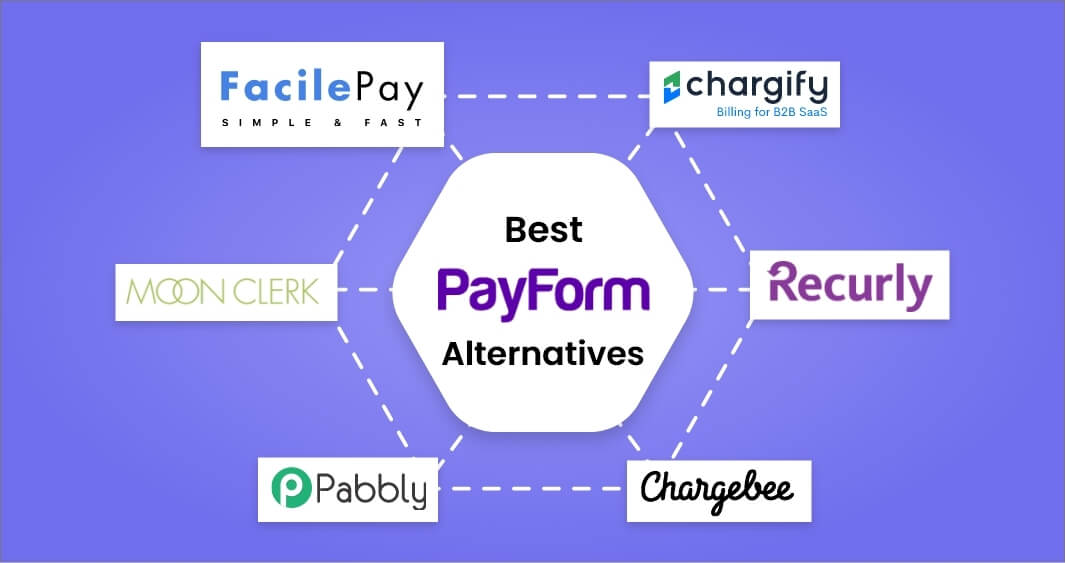

PayForm is an amazing tool to generate online payment forms. However, it is a bit expensive with a 1.5% per transaction fee, and might not be a good fit for some businesses. Hence, in this blog, we will discuss the 6 best PayForm alternatives along with their features, pros, and cons.

Contents

Here are the top 6 PayForm alternatives for one-time online payments.

| PayForm Alternatives | Rating | Pricing |

|---|---|---|

|

4.2 | Small- $15/month Full- $29/month Pro- $99/month |

|

4.4 | Rise- $299/month Scale- $599/month Enterprise- Custom |

|

4.3 | Standard- $10/month Pro- $26/month Ultimate- $70/month |

|

4.3 | Essential- $599/month Growth- Contact sales team Scale- Contact sales team |

|

4.4 | Basic- $18/month Plan 2- $35/month Plan 3- $60/month Plan 4- $90/month Plan 5- $130/month |

|

4.5 | Core- $249/month Professional- Contact sales team Elite- Contact sales team |

1. FacilePay

FacilePay is the best PayForm alternative platform. You do not need a signup account; open the website and generate simple payment forms. Moreover, it allows you to accept recurring payments and one-time payments using online payment forms in 5 minutes.

FacilePay serves several industries and helps them reduce delayed or missed payments and customer reminders. Industries such as small businesses, healthcare, daycare & childcare centers, schools, and nonprofits use FacilePay to create payment forms.

Features of FacilePay

- Sharing of embedding links through email, social media, or third-party applications

- Creating customized payments form including title, pricing, and color scheme

- Integrated with Stripe and PayPal

- Offers multiple payment options like debit and credit cards

- An overview of customers, payments, and revenue generated metrics under single platform

| Pros | Cons |

|---|---|

| No sign-up- There is no mandatory sign-up option. | Authority domain- Cannot connect with your own domain. |

| Analytics metrics- Get a report of how many customers, payments, and revenue you have made. | |

| Secure payment- It is a safe payment process with seamless integration. |

2. Chargebee

Chargebee is a recurring billing and subscription management platform for SaaS and subscription-based businesses. The software is integrated with platforms like Quickbooks online, NetSuite, Salesforce, MailChimp, and Shopify.

Features of Chargebee

- It has powerful subscription billing

- Allows using multiple currencies

- Configurable smart dunning and recurring invoices

- Custom personalized billing and pricing

| Pros | Cons |

|---|---|

| Single billing system- It helps to save time and effort for the team to do payments. | Complex configuration- It is complicated for beginners to understand. |

| Accept quotes- Easy to create and send quotes for users. | Email templates- Not an easy way to send emails to one client. |

| Customization- Great variety for customized billing. |

3. Pabbly Subscriptions

Pabbly is a subscription management software that helps you to collect payments easily. The software has a pre-built multiple-form template to generate various forms. It is a PayPal and Stripe-powered payment system.

Features of Pabbly

- Subscription and invoice status

- Send notifications on multiple platforms

- Offer unlimited submission reports

- It has multi-page forms

| Pros | Cons |

|---|---|

| Repeat billing system-It is easy to set up a repeat billing process. | Authentication-Ask for two-process authentication to use multiple platforms. |

| Multiple plans-Design multiple plans for the subscription business and other core businesses. | Numerous email notifications- Do not provide any email notifications. |

| Revenue collection- There is no limit on revenue collection. |

4. Chargify

Chargify is a recurring billing and subscription platform. With Chargify, you can administer multiple accounts; also, change billing dates and amounts. It helps to support all your recurring billings.

Features of Chargify

- Provide revenue retention

- Allows to track and manage subscription billing

- Multiple payment options for customers

- Integrated with QuickBooks, Xero, or NetSuite

| Pros | Cons |

|---|---|

| Powerful APIs – It makes processes more accessible and better. | Coupon feature- The coupon process is complex. |

| Invoice process-Easy overview of payment options makes the invoice process uncomplicated. | Restrict customization- Cannot easily customize email, invoices, and landing pages. |

| Personalization- It is simple to navigate and personalize with different systems. |

5. MoonClerk

MoonClerk is a recurring and one-time payments online platform. It allows flexible billing options, maximize checkouts, and helps with auto-charging cards. You do not need a merchant account for payments.

Features of MoonClerk

- Administrative automation

- Flexible recurring payment options

- Set custom recurring frequencies

- Configuring payment forms

| Pros | Cons |

|---|---|

| Setup – It is user-friendly and easy to set up. | Limited bank support – It does not support many banks for the payment process. |

| Simple Invoicing- Easy overview of payment options makes the invoice process uncomplicated. | Prices vary on volume sales- The price increases when your sales escalate. |

| Drag and drop- The integration process of the Stripe account is effortless with the drag and drop option. |

6. Recurly

Recurly is a subscription management and recurring billing platform. It helps to manage all subscriber data in one place. Also, users can add, change, pause, and cancel subscriptions.

Features of Recurly

- Recurring payment options

- Reporting and analytics

- Third-party integrations

- Store credit cards data

| Pros | Cons |

|---|---|

| Major credit cards- All credit card service is accepted. | Invoice- The invoice process is a bit complicated and difficult to edit. |

| Configurable- It is easy to configure multiple payment gateways. | Customization- It has limited customization options. |

| APIs- The APIs are powerful and flexible to use. |

Frequently Asked Questions

-

Is there any PayForm alternative that offers recurring payments?

Yes, there are alternatives such as FacilePay, Chargebee, Pabbly Subscriptions, Chargify, MoonClerk, Recurly, and Stripe that offer recurring payments.

-

Does PayForm alternatives allow me to set up multiple users and permission?

Yes, all PayForm alternatives mentioned above allow you to set up multiple users and assign different levels of permission and access.

-

Are there any alternatives to PayForm that offer a free trial period?

Yes, there are several PayForm alternatives that offer a free trial period with no credit requirement. They allow testing out before committing to paid plans.

Opt for Your Ideal PayForm Alternatives

There are numerous payment process solutions in the market. Every software has diverse features and has something to offer to businesses. However, not every platform will be the best fit for your business.

Therefore, research and compare different options of PayForm alternatives. As a result, choose one PayForm alternative that is relevant to your business and matches your requirements.