📝Key Takeaways:

- Recurring payment apps can help businesses and individuals save time and money by automating payment processing.

- Popular recurring payment apps include Stripe, PayPal, and Square.

- Businesses should consider factors such as transaction fees, user experience, and customer support when choosing a recurring payment app.

- Recurring payment apps can offer features such as customizable payment forms, subscription management, and invoicing.

Being a subscription business owner, you must have hundreds of things to focus on for creating better deals for customers and generate revenue. In such a scenario, you need a defined process and efficient technical support to increase your net worth. Here’s is when you encounter questions like:

- How to manage subscriptions and users consistently

- How to process recurring invoices and subscription charges without errors

- How to automate savings from each billing cycle and track with accurate data and analytics

- How to perform budgeting and optimize subscription costs to benefit both customers and the business

If you are juggling with these above set of questions, you will find solutions using software for recurring transactions that manage your subscriptions from start to end.

This blog is the ultimate guide for you to learn about the best recurring payment apps in the market for tracking and managing subscriptions.

Through this guide in 15-18 minutes, you will gain a detailed understanding on:

- The Best recurring payment apps for efficient tracking and management of subscription services (+ examples)

- Steps to decide the best recurring payment app for your subscription business

- How using recurring payment apps can benefit your business

So, are you ready? Let’s get started.

Contents

- 4 Best Recurring Payment Apps for Your Subscription Services [Pros & Cons + Examples]

- How to Decide the Best Recurring Payment App? [A Step-Wise Guide]

- What are the Benefits of Using a Recurring Payment App?

- Frequently Asked Questions About Recurring Payment Apps

- Manage Your Subscriptions and Recurring Payments with the Best Recurring Payments App

4 Recurring Payment Apps for Your Subscription Services

Below listed are the 4 best recurring payment apps that you may need to automate your business.

| Logo | Recurring Payment Apps | Ratings | Reviews | Download Link |

|---|---|---|---|---|

|

FacilePay |

Android 4.5+

iOS 4.5+

|

Android: 1L+ iOS: 185 |

|

| Square POS |

Android 4.8+

iOS 4.8+

|

Android: 1.65L iOS: 334.9K |

|

|

| Zoho Subscription Billing |

Android 4.0+

iOS 5.0+

|

Android: 181 iOS: NA |

|

|

| PaySimple |

Android 3.8+

iOS 4.0+

|

Android: NA iOS: NA |

|

We just saw the top four recurring payment apps. Let’s discuss each application for automatic payments in detail to help understand which application works best for you.

1. FacilePay – Accept Payments From Anywhere at Anytime

FacilePay is one of the top recurring payment apps having 100,000+ downloads on PlayStore and has 4+ ratings on both the app stores. This app works with the Stripe payment gateway which makes it highly secure with stringent compliance standards. There are more than 135+ currencies that FacilePay supports for accepting recurring payments.

With 1.74K users managing recurring invoices and payments, this app can manage POS and recurring payments for popular subscription services. It is a budgeting app that manages your payments and enhances your profits. All you need to pay for this one of the best recurring billing software is a 1.25% per transaction fee. Isn’t it amazing?

You can use FacilePay if you are

- Small business and looking for an easy-to-use payment solution for processing recurring invoices

- Budget-friendly solution to accept payments

- Looking to track transactions with a detailed reporting system

- Recurring billing and payments

- An instant online payment solution

- A multi-currency support system

- Hassle-free invoice management

- Item management

- Shareable payment links

Let’s understand some of the pros and cons of using FacilePay.

- FacilePay is an easy-to-use application for accepting recurring payments with no complex programming or setup system.

- You can gain real-time insights about your net worth and account based on recurring transaction data.

- Using FacilePay, you can accept payments in any method or mode such as credit cards, debit cards, ACH transfers, and online payments.

- You don’t have to pay anything to sign up and set up recurring transactions.

- You will be charged a nominal 1.25% transaction fee on each payment using this app.

- FacilePay follows a flat fixed rate pricing structure that may not work for large businesses with multiple subscription plans having different customizations.

Which Businesses Use FacilePay?

- Hawaiian LuauHawaiian Luau is a catering service provider with around 15-20 delicious Hawaiian cuisine dishes on its menu. These tasty dishes range from $7 to $20 to give an affordable royal luau or feast to their customers. They used to accept cash and card payments. People don’t carry much cash nowadays and even if they do, they don’t have change. This wasted a lot of time. This is where FacilePay came into the scene.

Using FacilePay, they didn’t need a card reader for this payment app. The company just has to enter card details themselves or use a smartphone camera enough to scan the card. Another cool feature is tapping the PayWave/PayPass logo on the back of an NFC device. It takes less than 30 seconds to charge a card. This saves a lot of time and effort.

- Beach Resort in ThailandThis resort used to accept online and offline payments. The customers could pre-book the villa or stay. However, they had to pay at the hotel front desk when it came to activities. This meant cash payments. People didn’t carry the required cash, and credit card payments were expensive to the hotel owner.

With FacilePay, they could manage payments via credit cards without spending a lot on transaction fees. The company used FacilePay as it is an mPOS system as well as an app accessed via smartphone with several added features like online payments and items management.

In fact with FacilePay, the company created and sent professional invoices in seconds and got payments made directly inside the invoice.

Here’s one of the top testimonials from the client using FacilePay.

2. Square Point of Sale (PoS) – Track Payments in Real-time

If you are a small business owner and looking for a top-notch POS solution, Square POS is an easy-to-use and cost-effective mobile app. You can use this POS app with Square Reader for contactless payments using payment links, QR codes, Apple Pay, and EMV chip cards. This combination of hardware and software ensures that you can take payments instantly and even update the inventory on the go.

Through this Square POS app, you can issue, track, and customize your invoices directly from the app. In fact, you can set up weekly, and monthly recurring invoices and allow customers to pay online through credit/debit cards. You can use it as your invoicing solution and send out recurring invoices automatically with the payment link. This will allow you to send out timely invoices and receive the payments within the set period. For every transaction via Square App,

Features of Square POS

- Issue and track invoice

- Inventory management

- Recurring payments and monitoring

- Ordering automation

- Loyalty program

- Discount management

3. Zoho Subscription Billing App – Automate Billing and Collect Payments On-time

Zoho Subscriptions is an online subscription billing platform for businesses of all sizes. It is a simple solution for companies looking to automate subscription management and recurring billing. This application enables businesses to take full control of events throughout the customer’s life cycle, from signup to recurring payments. This recurring billing and subscription management solution are ideal for membership businesses and SaaS billing.

With the Zoho app, it is easy to manage the lifecycle of customers’ subscriptions from a mobile device. In fact, you can create multiple plans, manage customer subscriptions, collect payments securely, and get detailed metrics on your business’ health.

Features of Zoho Subscription Billing App

- Comprehensive dashboard

- Subscription monitoring

- Instant notification

- Data protection

- Manage invoices

- Receive and track periodic updates

4. PaySimple Mobile App- Collect Payments From Anywhere

PaySimple is the leading payments management solution for service-based businesses. This payment app is available for all PaySimple users and enables them to accept all forms of electronic payment – including all credit cards, debit cards, and checks. This payment is accepted either through established payment methods for past customers or through a swipe of a card on the new mobile card reader.

This billing platform helps to set up billing schedules for recurring payments, including online, in-person, or mobile payments. PaySimple gives you the ability to store and manage customer information. With these records, you can do things like send automated receipts, appointment reminders, and invoices.

Features of the PaySimple App

- Flexible mobile-friendly payment options

- Real-time updates of settled payments and cash flow

- Customer relationship management

- Quickbooks integration

- Unlimited recurring billing schedules

Let’s take a look at how you choose the best recurring payment app for your needs

How to Decide the Best Recurring Payment App [A Step-wise Guide]

The market is flooded with applications that can help with recurring payments. Choosing the one that meets your business needs and is aligned with your goals is important. Let’s discuss the steps you can take to evaluate the apps and select one.

1. Evaluate and Create a Checklist of Your Key Recurring Payment Requirements

What is the purpose of the recurring payment app? What do you need to ensure the subscription services are a success? Answering these two questions will help you choose the must-include features and determine the platform’s requirements.

- You should choose a platform that offers point-to-point encryption to safeguard against data breaches

- Ensure the provider meets the defined payment industry standards

Features should be next on your evaluation list. You should know the features that can help you get more subscriptions for the platform. For example, will payment reminders help people connect to your digital subscriptions?

- Direct Debit SCH is an important feature that allows you to get paid from the customer’s bank account without any mediator

- Automated Level 3 Processing ensures that the customer need not fill out long forms and excessive details to get their subscriptions started

Support is equally important when you are looking for recurring payment services. The support should be strong and accessible.

- In case you want to migrate to another platform, you should be able to do so without vendor lock-ins

- The support service should offer instant help and provide you with necessary technical support

2. Analyze Your Unique Customers and their Needs

Having identified the requirements is the first part of the selection process. It is equally important to know your customers and check their requirements. Do they want a single place where they can manage all their subscriptions? Are they looking for specific payment methods? Do they want tools that can help save money?

Do they want you to send payment reminders? Every customer is unique. You might want to conduct a detailed analysis of the customer requirements before determining the features and services you wish to add.

For example, Netflix offers different features for premium users. Their payments are easy to access and require a low learning curve. Additionally, they are safe, meaning the payment details are secure. As a result, more users prefer automating payments on Netflix.

3. Consider Your Budget for the App

Pricing is pivotal in selecting the recurring payments application for your requirements. If the starter pack is priced at a high rate, you might want to consider something other than the application for your business requirements.

It is very important to have a defined budget in mind. This will help you know which application fits your price range. The budget also depends on the features you want to include in your application. Do you need budgeting tools? Looking for bill negotiation features?

These things will help you plan the budget and select the recurring payment app accordingly.

Now that we have seen how to select a recurring payment solution let’s discuss why your business needs one.

What are the Benefits of Using a Recurring Payment App?

Almost all eCommerce platforms that run subscription solutions offer recurring payment options. There are several benefits associated with this. It helps you get complete visibility into the revenue your business can generate.

Here we will discuss the top three benefits associated with recurring payment platforms.

1. Trackable Recurring Payments Making Subscription Management Simpler

When you invest in a recurring payment platform, you make it easier for your business to keep track of the payments. You are aware of the revenue your business is likely to generate month-on-month.

With a single app, you can track all payments from individual customers and businesses.

You won’t need to invest in separate resources for accounting and budgeting. At the same time, you don’t need to check different software to know the payables and customers who are leaving the system and understand the revenue you are likely to lose in the month.

This insight and real-time data allow you to take the necessary actions to prevent losing your customers.

2. Automated Process Minimizing Scope of Errors

If you were to complete the billing processes manually, you might make mistakes in the charges levied on the end user. If you forget to send the user reminders for payments or miss out on a particular invoice, you lose on the profits.

By automating the process, you will ensure that the payments are made regularly. For example, reminders must be sent a few days before the billing cycle. The end users will know when their subscription will end. This process will ensure you don’t lose out on your precious customers and improve the profits from the same.

3. Better Customer Lifecycle Management Helping Businesses Grow

The recurring payment apps contain detailed information regarding the customer’s latest purchases, the subscriptions they prefer, and what they tend to purchase regularly.

It helps segment similar types of customers together.

Let’s take the example of the Streaming Platform Disney+Hotstar. If more people prefer using this app on their mobile, they might want to segment these customers and define a plan specifically for the mobile device. Depending on the usage, the ability to pay for the monthly subscriptions, and other aspects, you can improve the plans and prevent people from moving away from your platform.

With a detailed insight into the customer lifecycle, you can increase retention and prevent churn. It will improve business profits and, eventually, growth.

Frequently Asked Questions About Recurring Payment Apps

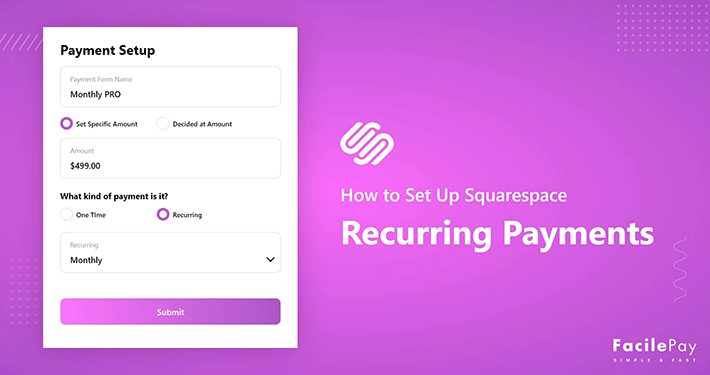

-

How to set up and automate subscriptions for customers using recurring payment apps

- Go to the admin panel, and click on the products or plans that you wish to include in subscriptions

- Select the payment schedule and offer a recurring payment option in it

- Offer an opt-in button to allow customers to choose the recurring

- Identify the schedules for the recurring payments

- Setup the reminders

- Offer multiple payment methods and storing options

- Once you have completed this, preview your subscription

- Click on save to set up and automate the subscriptions with recurring payment options.

-

What security features to consider in a recurring payment app to avoid fraud?

Here are some features that make the recurring payment app secure:

- Two-factor authentication before setting it up

- OTP to complete the automation setup

- A message stating the following automation has been set up. This allows the user to cancel the subscription if they haven’t set it up

- Scheduled reminders before the actual auto-debit to ensure the users have automated the payment.

-

What are the mandatory features of a recurring payment app to be considered by every business?

You should include the following features to your recurring payment application

Feature Description Pause the Plan The user should be able to freeze the payment in the particular billing cycle if they don’t want to continue the subscription Payment Deferment In this case, the customer should be able to defer or avoid the payment in the first billing cycle. This will be important for apps where the first billing cycle is offered for free Change Billing Dates Customers may want to realign the billing date to manage their spending. The recurring payment app should make an allowance for the same. Advance Cancellation If the subscriber doesn’t want to continue with the plan, they should be able to discontinue it for the upcoming month Service Fees The payment app should support the business when they charge late fees, cancellation fees, etc. Push Notifications Whether the app wants to send an alert regarding a new feature update or a payment, there should be a provision for the same.

Manage Your Subscriptions and Recurring Payments with the Best Recurring Payments App

Recurring payments can help automate the billing cycle and give businesses a bird’s eye view into their revenue cycle. It will help them collect money from the customers, offer plans that resonate with the end users, and improve the retention rate.

You get a detailed understanding of your profits and likely attritions in the upcoming cycle. This data can be used to create campaigns and sales letters to ensure that your customers don’t leave the business and improve your sales.

You need to choose the recurring payment solution that best fits your requirement. Identify the most important features, discover where and how you need the payment solution, and choose the provider that fits your description.

As an upcoming and highly efficient recurring payment application, FacilePay offers free trials and cost-effective transactions. Take a platform demo to understand why it is a good choice for your business.