Are you willing to double down on your business profits by maximizing cash flow with more returning customers? Looking for a scalable solution?

If yes, then setting up recurring transactions for your product/services will benefit your business. But, what is a recurring transaction, and how can it help?

To know about recurring transactions, you have landed in the right place.

This blog will provide you with a detailed understanding of recurring transactions. You will learn the following from this article:

- What is a recurring transaction? [meaning + examples]

- Benefits of recurring transactions

- Steps to get started with recurring transactions

- 3 best recurring payment processors to know for your business

Seems interesting? Let’s get started.

Contents

What is a Recurring Transaction? [+Examples]

A recurring transaction is a recurring payment model with the potential to help your business scale accounts operations, reduce errors, and grow faster. This method brings convenience for customers with the transaction amount and the debit type.

Examples of Businesses Leveraging Recurring Transactions

-

A SaaS provider maximizing its cash flow and growth with automatically billed recurring transactions. As per the Fiscal 2020 results report by Dropbox, it has earned more than $2 Billion in total annual recurring revenue. The growth in terms of both revenue and customer acquisition shows that Dropbox could make recurring transactions work the best for the business. In fact, there are over 700 million registered users using this SaaS product which shows outstanding customer retention.

-

One of the leading streaming service providers in the world making the most from recurring transactions. Statista report says that Netflix generated a total revenue of around $7.93 Billion in the third quarter of 2022. Isn’t this an amazing revenue figure for their subscription model business? The growth Netflix experienced with customer cancels included is higher than any business could have achieved with a one-time payment model business.

Got clarity on recurring transactions? Now, let’s learn the top benefits of this payment model.

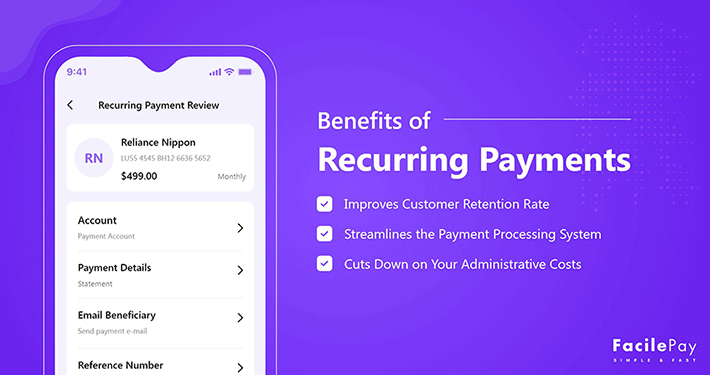

6 Benefits of Recurring Transactions

Recurring transactions work efficiently to make businesses earn profits, scale higher, and grow faster. This transaction type brings predictability to revenue and enables the planning of more precise growth strategies.

But, this is not the only reason for recurring billing and payments to win the market. There are many benefits to having a recurring payment plan for your business. Some of them are mentioned below.

-

Boosts Customer Experience With Worry-free Transactions

-

Increases Customer Retention Owing to Convenient Payments

-

Heightens Security for Advanced Fraud Protection

-

Greater Control on Revenue Flow With Predictable Income

-

Fewer Late Payments for the Recurring Billing Plan With AutoPay Enabled

-

Less Time Spent on Accounting for Maximized Business Growth

For every business, the center of attraction is its customers. Whether it’s about the product, service, or pricing strategy, everything revolves around the usefulness of the same for the end customer base. Why? Because a business can only grow and earn profits when there are returning customers. Recurring payments work to boost customer experience by enabling uninterrupted transactions on an ongoing basis for the goods or services used or accessed.

Hence, leveraging this solution can benefit your business revenue stream and overall brand image considerably.

PWC states that 80% of Americans consider speed, convenience, and knowledgeable service critical to positive customer experience. Recurring transactions bring this speed and convenience into the billing and payment structure of the business. By enabling automatic recurring payments, a business can boost its customer retention and enhance cash flow.

Thus, if you are looking for long-term customer relationships and a regular cash flow for your business, then recurring transactions can work wonders for you.

Security is a must when it comes to payments. There can be many critical fraud situations with customer pays and so ensuring adequate protection with strict compliance standards is a must. For recurring payments, it’s always good to use processors that have integrated payment gateways following the PCI DSS (Payment Card Industry Data Security Standards) policy such as Stripe or PayPal. Having this policy in place helps to keep customers’ payment information safe with stringent standards.

Recurring transactions enable greater control on the revenue flow. You can predict the income of your business and can adapt strategies for effective revenue management. This is really very helpful for sustainability in a competitive market. You can develop a well-planned, recession-resistant business strategy with this payment method as regular recurring payments flow stabilizes the sales fluctuations by generating consistent and predictable revenue streams.

Having recurring automatic payments enabled for your business reduces late or missed payouts for customers. When the payments are automatically processed and go into your merchant account without you having to chase them down, you can focus more on your business growth and build positive relationships with customers. This brings efficiency to the overall process.

Automated collection of recurring payments helps optimize accounting operations. Your accounts team doesn’t have to work on the tedious workflows to collect recurring payments allowing the scope to utilize the time in more productive tasks related to overall business growth.

The above benefits clearly show the ways recurring transactions can help your business to scale and grow. But, how should you start with recurring transactions? Explore the step-wise guide to get started with recurring transactions.

3 Steps to Get Started with Recurring Transactions

To create the right recurring payments structure for your business with beneficial outcomes require you to set up the process in a well-planned manner. Not doing due diligence in the initial steps can lead to a recurring transaction module with inefficient flows and unsatisfying results. So, what are the steps to get started with recurring transactions for your business?

-

Evaluate Your Product or Service for Automated Recurring Payments Structure

- What type of customers do you want to serve?

- What is the frequency of use for your goods or services?

- What challenges will your product or service resolve for the targeted customer base?

- How could you personalize your product/service with offers to attract your customers?

- How can you benefit your customers with the recurring payments model?

- What is the preferred payment method of your targeted customer base?

- What type of structure do you want to follow for recurring transactions? (eg, fixed recurring payments or variable/irregular recurring payments)

- Is the preferred payment structure for recurring payments you want to follow has any profit scope for the business?

- What your competitors are doing and how are they growing?

-

Make a Checklist of How Recurring Transaction Work to Improve Customer Satisfaction

-

Structure Your Recurring Transaction Plan to Fit Your Business Model & Subscription Economy

To start with recurring transactions, you need to evaluate your product or service offerings for the subscription box services model. You need to see if you can fit your business offerings into the recurring payments structure and earn profits. But, how can you do that? By answering the below questions and making a list of your answers to get in the right direction.

Answering these questions will give you a map to follow. You can understand whether your product/service offerings fit the recurring transactions model and have any benefit to add to your business. Now, let’s make a checklist from these answers in the next step.

Once you list down the answers to the questions in step 1, you can understand and better define your unique proposition for improving customer satisfaction. This will also help you evaluate the overall growth objectives.

With this, you can create a checklist for you and your business that will work as a guiding agenda or target. For example – Dollar Shave Club & Adobe. Both of these brands have switched to recurring transactions and remodeled their product/service in a way that is delivering profit.

However, when working on the checklist to create a unique business proposition using recurring transactions to improve customer satisfaction, there are a few aspects you should consider. What are they?

Let’s have a look.

3 Important Things to Consider with Recurring Transactions for Longer Customer Relationships

| Factors | Why Should You Consider? |

|---|---|

| Transparency | Customers like businesses with clear pitch and straightforward pricing. Having transparency build trust in customers and create a lasting relationship. |

| Security | You can’t miss out on security and compliance. With growing cyber attacks and fraud activities, customers always choose secured solutions. |

| Flexibility | Customers love businesses that value their unique needs and customize things for them. Giving flexibility with recurring transactions can broaden your scope for returning and loyal customers. |

If you keep these factors in mind while creating a recurring transaction plan for your business, you will definitely improve your cash flow and build a brand impact with a great customer retention rate.

Now is the time to take the action and actually execute everything evaluated and planned. As soon as you are ready with the checklist mentioned in step 2, start getting the plan executed. Customize or newly create a product/service as per the plan and set it in the recurring transaction structure. You will also need payment processing software to set up recurring transactions. Also, ensure that you are aligned with the competitive criteria of the subscription economy when setting up to collect recurring payments.

Once you are done with this, you are all set with recurring transactions for future payments. However, you need to market this to your customers to get the benefit of the recurring payment model.

The above steps have provided you with a clear path on how to get started with recurring transactions. Let’s now get to know the best 3 payment processors to use for this.

3 Best Recurring Payment Processors

There are many processors or softwares in the market for setting up recurring transactions. But, if you want to maximize your profits with streamlined operations to manage on your part, then using any of the below three software will benefit you.

-

Square

-

Braintree

-

FacilePay

Square is among the best recurring payment processors in the market for businesses of all types and sizes. It has got featured in Entrepreneur, The Next Web, SC Magazine, and so on. You can make recurring transactions simpler, efficient, and secure for your customers with this processor. Customers trust using this software. It has received 4.7 stars in Capterra and 4.2 stars in Trustpilot.

Braintree is used and trusted by top brands like Dropbox and Uber. You can collect recurring payments from your customers in a risk-free and streamlined manner. It is among the best payment technology from Paypal with scalable solutions and outstanding support by the world’s largest and most trusted fintech brands. Paypal recurring payments services by Braintree make transactions work the best for your business.

FacilePay is outperforming in the market as an application for accepting automatic recurring transactions. Being one of the best recurring payment processors, FacilePay is trusted by 1.75K (as per Android Play Store) people for accepting payments on a recurring basis. You can very easily set up recurring payments in this app. Users rated the FacilePay app with a 4+ rating in Google Play and Apple Store.

These above-mentioned three processors are among the best for recurring charges or transactions. If you want to leverage recurring transactions for your business, you can try using any of the above-mentioned softwares for gaining the maximum benefit.

Let’s now get some common queries or questions on this topic answered.

Frequently Asked Questions About Recurring Transactions

-

How do recurring transactions work?

To process recurring transactions, businesses must have payment processing software and a merchant account. Here is an overview of how a recurring transaction works.

- First, the customer selects recurring payments for the goods or services

- Second, the customer accepts the terms and conditions and authorizes the payment details

- Third, the customer submits the bank detail and other necessary payment information

- Fourth, the payment processor receives the payment request and alert the customer’s bank

- Fifth, the funds are transferred to payment processor after approval from customer’s bank

- Sixth, the funds are released to merchant account

- Seventh, billing invoice is sent to customers

This process repeats on each billing cycle with the payment processing software initiating each transaction and providing the customer with an invoice.

-

Which are the different payment methods to support recurring transactions?

The important payment methods that should be catered for recurring transactions include the following.

- Credit or Debit Cards

- Direct Debits or ACH Recurring Payments

- Online Payments

- Digital Wallets

If you accept recurring transactions in these above methods, you are not going to lose customers due to payment troubles.

-

How can you reduce the risk with recurring transactions?

You can reduce the risk with recurring transactions by following the below practices.

- Follow strict compliance and security policies like PCI DSS (Payment Card Industry Data Security Standards) and also align with the guidelines of the bank as well as the credit and debit cards to be accepted

- Maintain clear payment guidelines with set terms and conditions with cancellation policies

- Set automatic reminders before charging customers with recurring transactions

- Follow up with customers for their feedback on experience to understand the impact of the recurring transactions model

- Monitor and analyze chargeback data for effective measures for upcoming payments

Recurring transactions work as a viable and effective strategy that has the potential to help your business grow. However, this isn’t a risk-free option as well. You should mitigate the risks with recurring transactions to actually benefit from them.

-

How much does it cost to develop a recurring payment app for your business?

The cost to develop a recurring payment app will depend on your unique requirements and the app’s complexity. However, the general factors that lead the budget to develop an app include:

- Development time

- UI/UX designers

- Developers

- Testers or QA analysts

- App maintenance and upgrade criteria

If you have the budget you can build an app from scratch keeping the costs of acquiring all these above factors. Alternatively, you can also choose to register in a payment software or app already in the market with flexibility in feature offerings to cater to your customers.

Ready to Get Started With Recurring Transactions?

Recurring transactions have quickly taken over the market owing to its viability in terms of customer convenience, business growth, and predictable revenue flow. This new avenue has transformed the payment cycle for customers completely. If you want to keep up with the market competition and leverage recurring payments to the maximum, then you should consider remodeling your product or service. Many big brands have done this and have achieved great success. So, are you ready to make your move with recurring transactions?

If you want a secure, simple, and efficient payment processing app or software to support your move to recurring transactions, consider using FacilePay. This app solution will help scale your business efficiently and maximize revenue flow for you.