Quite often?

If yes, then probably you need a good mobile payment app to support your small business with daily transactions.

Reason?

A mobile payment app will make it convenient, faster, and cost-effective for you to handle transactions for your small business.

But, how to find the best payment app for your small business?

Don’t worry, we have got you covered.

This article will provide you with a list of top payment apps available in the market for small businesses.

Here’s everything you will learn from this blog:

- What are mobile payment apps?

- What are the 3 best mobile payment apps in the market for small businesses?

- What are the benefits of mobile payment apps?

Let’s begin right away.

Contents

What are Mobile Payment Apps?

Mobile payment apps are processors that facilitate payment solutions via iOS or Android devices. In simple words:

You can use a mobile payment app for everything that a traditional POS system does via a credit/debit card terminal, as long as you have access to the right technology.

In fact, you can have access to several additional features with a mobile payment app that you don’t have with traditional POS systems. Such as:

- Billing and accounting

- Accepting payment online

- Multi-currency support

- Multi-period billing and payments

- Real-time reports to transactions

With mobile payment apps, your day-to-day transactions with different payment methods become convenient, quicker, and affordable as compared to the traditional payments system.

Hope, you are clear with the definition and meaning of mobile payment apps. Now, explore the three best mobile payment apps for small businesses.

3 Best Mobile Payment Apps for Small Businesses

Feeling overwhelmed with the varied options available in the market for payment solutions? You are not alone.

Every business trying to improve and streamline its day-to-day transaction processes is facing this dilemma. For small businesses like food catering services providers, it becomes more of a headache to find a reliable solution.

To help you, below we have mentioned a curated list of payment apps that work best for small business types.

-

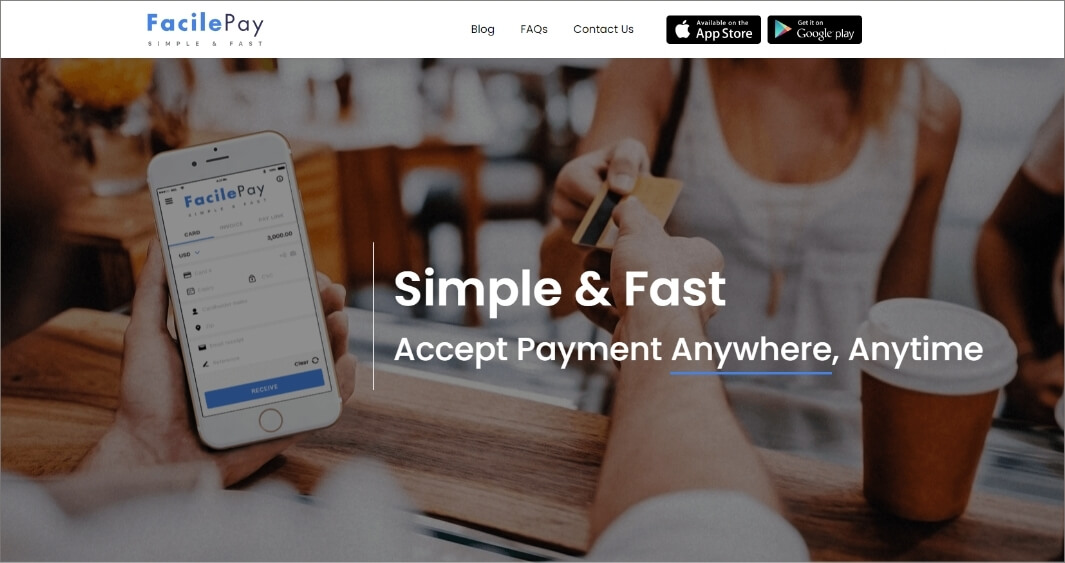

FacilePay

FacilePay is a simple, efficient, affordable, and easy-to-use mobile payment app solution for small businesses. This is a mobile point-of-sale app with features of:

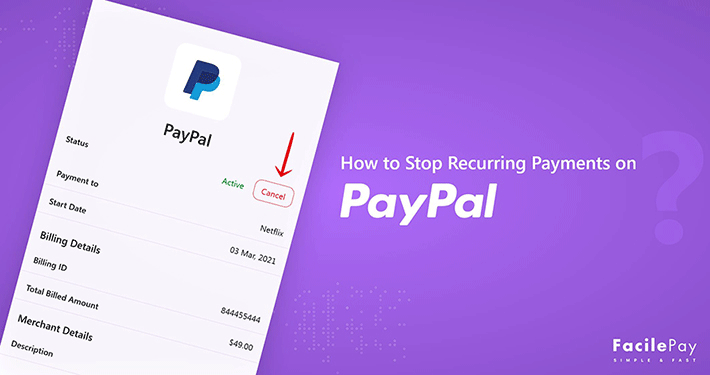

- Recurring billing and payments

- An instant online payment solution

- A multi-currency support system

To provide a better overview, below are the benefits of this mobile payment app listed.

Benefits of FacilePay Convenient acceptance of payments via credit cards, debit cards, ACH method, and online. Affordable transaction fee [1.25% flat-rate amount charged on each transaction – no additional or hidden fees are there]. Real-time tracking and reporting of cash inflow and outflow. Simple, quick, and efficient set-up and processing solution for recurring billing and payments. Hassle-free invoice and payment processing. Multi-currency support enabling you to accept payments from anywhere. NFC-enabled system to accept payments from credit cards and debit cards [enabled with card reader features]. Secured with Stripe payments gateway that complies with PCI DSS standards. FacilePay has been a very convenient and easily adaptable mobile payment app solution for small business types. Below is a case example highlighting the experience of a Hawaiian food catering services provider. Refer to it for insights on how FacilePay helped this business streamline its payments.

How FacilePay Helped a Hawaiian Food Catering Services Provider With its Transactions

Hawaiian Luau is a catering service provider with around 15-20 delicious Hawaiian cuisine dishes on its menu. These tasty dishes range from $7 to $20 to give an affordable royal luau or feast to their customers. Their customers are extremely happy with the quality of the food and there is a good flow of business for them.

Everything sounds perfect, doesn’t it? Well, it actually wasn’t. They faced a few problems with their transactions and this is where FacilePay came into the scene.

To get a close insight into the reasons this Hawaiian food catering services provider chose FacilePay, we had a chat with them. The friendly team at the catering service is more than happy to answer our questions.

Below is their short feedback interview.1. What problems did you face before getting FacilePay?

Well, we are a small business. All our dishes cost around $7 to $20. We used to accept cash and card payments. People don’t carry much cash nowadays and even if they do, they don’t have change. Sometimes we don’t have change. This wasted a lot of time for both parties.

While with card payments, the terminal cost for such small-amount bills was too high to afford. This made our transactions quite expensive.

#Challenge: Time & Cost2. How did you find out about FacilePay?

Once one of our teammates was looking for a change and it took him too long to find it. In fact, he made a mistake with the calculation in all this haste. The customer saw this and suggested him to use FacilePay.

The customer himself was the owner of a small business and used FacilePay for digital payments. He even explained our teammate about it.

Our teammate brought up this suggestion during our very next meeting. All of us listened to it intently. We went up to your website and were impressed with this simple and efficient app. This is how we found out about it.

#Referral-based Choice3. How is FacilePay working out for you?

We don’t need a card reader for this payment app, just entering card details ourselves or using a smartphone camera is enough to scan the card. Another cool feature is tapping the PayWave/PayPass logo on the back of an NFC device. It takes less than 30 seconds to charge a card. This saves a lot of time and effort.

It charges only 1.25% per transaction which makes it really affordable just like our dishes. No monthly or hidden charges either. We can also accept tips easily.

Our excel maintenance labor has also reduced as we can see the weekly, monthly, and quarterly sales reports. All in all, the app works very well!

#Solution: Convenience & Affordability -

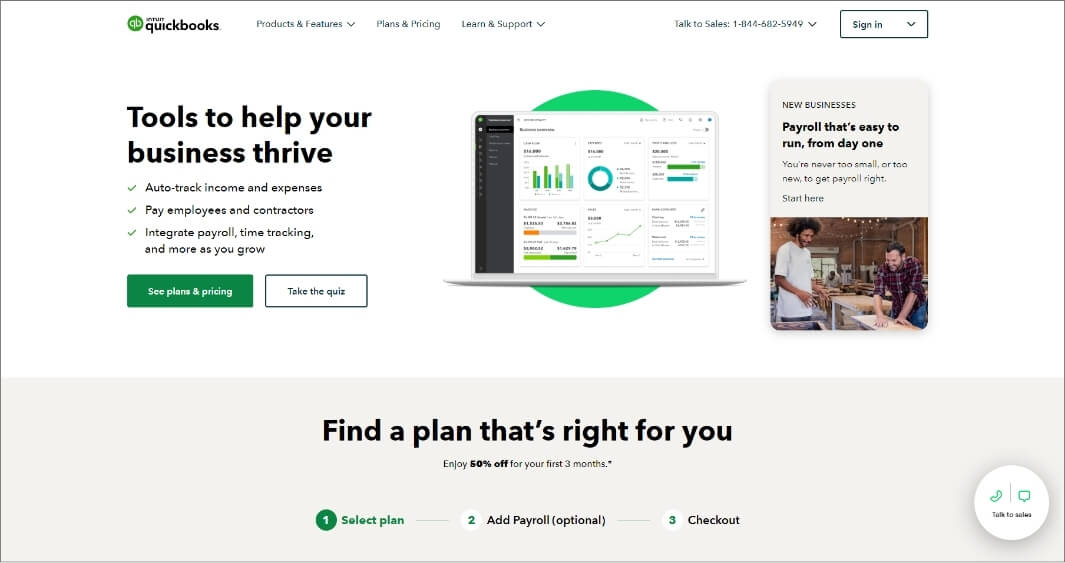

QuickBooks Online

One of the best mobile payment apps for small businesses is QuickBooks online. The reason this app works best for small business types includes the:

- Apps intuitive interface

- Ability to accept multiple payment methods

- Easy cash flow monitoring

- Setting recurring invoices

- Instant online payment system

- Efficient tax calculation

To put it simply, this app is a quick software solution for all payment or transaction-related tasks.

To better understand, get a short overview of the benefits of this mobile payment app from below.Benefits of QuickBooks Online Provide full-suite accounting assistance. Convenient acceptance of payments via credit cards, debit cards, ACH method, and online. Minimal transaction costs [ACH bank transfers with a 1% fee on each transaction, Card swiped payments with a 2.4% fee on each transaction + $0.25 extra, Card (keyed) payments with 3.4% fee on each transaction + $0.25 extra, and Card invoiced with 2.9% fee on each transaction + $0.25 extra]. Real-time cash inflow and outflow tracking and reporting. Easy set-up solution for recurring billing and payments. Quick processing of invoices and payments. Efficient tax monitoring and deductions. So, are you looking for a mobile payment app for your food catering services business? QuickBooks can be the best payment app solution for you. Consider evaluating its features.

-

Square Payments

Square payments app is among the most known mobile payment apps used by businesses of all types and sizes. It has features that help provide payment solutions to several businesses including:

- Food & beverage

- Beauty & wellness

- Retail

- Large businesses

Some of the features that make this mobile payment app among the best in the market include:

- Mobile point of sale system

- Contactless payments

- Online payments

- Custom invoices management

- Full-suite accounting solutions

- Ability to accept payments in multiple methods

- Easy set-up of recurring payments

- Comprehensive reporting system

The features and utilities of Square are limitless. As a business, you can maximize the potential of your payment strategy with this payment app.

To get a better overview, take a look at the benefits of this payment app.Benefits of Square Accept payments via multiple methods such as credit cards, debit cards, ACH payments, and online payments. Affordable charges on each transaction with no hidden costs [custom pricing solutions for each business type]. Advanced tracking and reporting of cash inflow and outflow, inventories or items, gaps, and churns. Full-suite recurring billing and payments solutions. Optimal support for low-volume merchants or businesses. Comprehensive billing and invoicing solutions. Multi-store payments and billing management. Simple handling of refunds. Optimal tax management system. The Square payment app is made for all business types with solutions created for a wide variety of transaction challenges. This is among the best payment apps in the market. Any business who have multiple stores or outlets and has diverse requirements with their payments and billing strategy can use this app to get all solutions in one place.

How to Choose the Right Mobile Payment App for Your Business

With varied options, choosing the right technology solutions always becomes a challenge. Small businesses often struggle in these areas because they neither have the time nor the money to experiment with different payment apps. Having these challenging aspects in mind, the below list is created to guide small businesses like yours with their decision-making process.

When choosing the best mobile payment app suiting your business requirements, it is critical to consider the aspects of the below checklist.

-

Costs: Check for the costs per transaction with any additional fees to be paid before or after when deciding on the mobile payment app to choose. Every app has different features with varied costs. You as a small business should evaluate the costs as per your requirements and budget.

For example – FacilePay has a fixed 1.25% fee on each transaction while Square Payments and QuickBooks Online have a packaged feature solution for your business type.Security & Compliance: As a small business, every chunk of payment matters. Evaluating the security and compliance standards helps you keep your transactions safe from any risks. This not just boosts your customer’s experience but also helps your business grow risk-free. You should always check the kind of security standards followed and then choose a mobile payment app.

Quick Tip: Always choose payment apps that use secured gateways following standards like PCI DSS and have policies of not storing payment information within the system.- Convenience in Terms of Use & Integration: There is nothing more important for a small business like yours than having the utmost convenience. Whether you run a catering business or a carpenter store, you are already dealing with plenty of things that become overwhelming to handle at some point in time. You can’t add more tasks to your to-do list with a mobile payment app as well. Hence, check for a mobile payment app that offers ease and convenience in terms of use and also integration. You should not need to spend much time or effort to integrate the app with your payment system to start operating it.

- Customer Service: Pick a mobile payment app that offers quick and efficient customer service and where you are valued as a client. You should get the right help as you seek it.

When executing recurring payments for small businesses, the same checklist should be followed. Your decision with the payment app will determine your success with revenue growth.

Frequently Asked Questions About Mobile Payment Apps

Why should a small business have a mobile payment app?

A mobile payment app makes transactions simpler, quick, and efficient for small businesses. Not just that, with an app solution the business can scale faster and also save on a lot of costs. Payment apps open the door for instant transfer of money via online methods as well as credit or debit cards without paying any additional fee via your own mobile device.

Are mobile payment apps better than traditional card readers?

Mobile payment apps are surely better than traditional card readers because it offers several additional features like accounting solutions, tax tracking and payment, advanced cash inflow and outflow reporting, and churn rate mapping.

Mobile payment apps work better as compared to traditional card readers.

Ready to Sign Up for a Mobile Payment App for Your Catering Business?

There are several types of payment solutions in the market with varied features to offer for the unique requirements of different businesses. The best option for your small business must be affordable and allow your customers to make transactions easily. To conclude on the right choice for your business, you’ll need to reflect on the transaction fees/pricing, security, location coverage, hardware/software requirements, and customer support.

If you’re looking for a place to start, check out one of the most popular options highlighted in the article above. These options also work for the recurring payments model. If you are stuck with how to accept recurring payments online, these above processors can make your life easy with the best solutions. Rakesh Patel

Rakesh PatelRakesh Patel, the founder and CEO of FacilePay, brings 28 years of IT experience in payment automation technology, business strategies, operations, and information technology to the table. With his extensive knowledge and expertise, he has created a trustable solution that helps to accept payments online. This has helped businesses of all sizes to receive payments quickly and securely. His commitment to simplifying the payment process has led FacilePay to be an ideal choice for businesses. His aim is to provide a seamless payment solution for various payment types, including e-commerce, subscriptions, and online donations. Read More