- Online payment services can help businesses of all sizes to accept payments online securely and efficiently.

- They offer various features and functionalities, such as payment gateway integration, fraud protection, and reporting tools.

- Choosing the right payment service provider depends on factors such as business needs, the payment volume, and budget.

- Online payment services can save time and money, improve cash flow, and increase customer satisfaction.

📝Key Takeaways:

According to Statista, only 11% of consumers carry cash, and with the popularity of eCommerce, if you as a business do not have an online payment processor, you’re missing out.

Online payment systems do more than just transactions. They let you embed a payment form or a payment gateway link on your website to help your customers perform online payments securely and quickly without any reminders.

After thorough research and testing the best payment gateways, we have narrowed it down to the best 7 online payment services for your business.

Let’s have a look at each of them.

| Payment Gateway | Transaction Fee | Security Features |

|---|---|---|

| 3.5% + $0.49 per transaction | SSL encryption, two-factor authentication | |

|

2.9% + $0.30 per online credit card transaction | SSL encryption, two-factor authentication |

| 2.9% + $0.30 for online credit card transactions | SSL encryption, PCI-DSS compliance | |

|

3.49% + $.49 per transaction | SSL encryption, two-factor authentication |

| 2.59% + $.49 per transaction on cards and digital wallets | SSL encryption, PCI-DSS compliance | |

|

Interchange plus 12 cents per transaction for Visa and Mastercard and 3.3% plus 22 cents for American Express. | SSL encryption, PCI-DSS compliance |

|

2.9% + $0.30 per transaction | SSL encryption, two-factor authentication |

Contents

- PayPal – Easy for First-time Users

- Stripe – Convenient for API Customization

- Square – Quick for Online and Offline Selling

- Venmo – Peer-to-peer Payments

- Braintree – Accept Online Payment Via Various Payment Types

- Adyen – Pay-as-you-go Online Payment Service

- Amazon Pay – Online Wallet-based Payment Processor

- FAQs

- Find the Best Recurring Payment System for Your Business

1. PayPal – Easy for First-time Users

PayPal is undoubtedly the top payment service provider for a long while now. It has built an experience that has helped new users with easy transactions and checkout processes.

With 20+ years of experience in the payment industry, there are more than 360 million active users. According to research, consumers’ intent to purchase has increased by 54% if PayPal is the payment type.

Features of PayPal

- Seamless and secure checkout.

- No need to store credit and debit cards information like other payment processors.

- PayPal account accepts more than 100 currencies.

- Accept online payments in ways like QR codes, payment links, and buy-now-pay-later financing.

2. Stripe – Convenient for API Customization

One of the reliable payment gateways for online transactions. Trusted by millions of companies like Lyft, Google, Microsoft, Shopify, Uber, Slack, and many more.

Launched in 2011, Stripe has nailed almost all the sectors like B2B, B2C, eCommerce, Retail, SaaS, and Non-profit Fundraising. You can set up an embedded payment form, and add a pop-up hosted by Stripe where your users can provide credit card details, and proceed to the checkout page for online payment.

Features of Stripe

- Stripe’s API will easily link to your payments anywhere.

- Best-in-class security tools that protect against fraud and encryption of sensitive data.

- Certified to the highest compliance standards.

- Scalable and supports subscription businesses.

Square – Quick for Online and Offline Selling

Do you run a traditional way of collecting payments? Square is here to help you set up an online business by offering full support for physical card reading machines. Square is the fastest sales in person and online sales support too.

Square also offers a website builder if you don’t have one. It is easy to set up and publish. Simple to use, Square offers basic email marketing features to keep in touch with your customers, run campaigns, and grow awareness about new products and services.

Features of Square

- Customer-friendly design.

- Recurring payments and monitoring via POS

- Excellent support for low-volume businesses.

- Square supports in-person sales with its own POS system.

4. Venmo – Peer-to-peer Payments

Venmo allows users to add their credit and debit cards or bank account information. An easy online payment solution to accept payments from your peers quickly and transfer them to your Venmo account.

Set up a business profile on your Venmo account so users can find your profile on the app. If you have a Venmo account added to your website, users will find the option right next to PayPal. Once they select Venmo to make the online payments, they will direct to the Venmo app to complete the payment process.

Features of Venmo

- Best for personal use to transfer and receive an online payment like Google Pay.

- Request funds, and create reminders for someone to pay.

- Transfer money to your account the following day.

- Get instant transfer for a small fee.

5. Braintree – Accept Online Payment Via Various Payment Types

With Braintree, customers get multiple options of online payment systems like PayPal, Venmo, debit cards, credit cards, Google Pay, and more. There are no monthly fees or setup needed.

Braintree is used by leading brands like Uber, Dropbox, Yelp, GitHub, etc. This payment processing system offers to store information for repeat customers for recurring payments.

Features of Braintree

- Level 1 PCI-compliant service provider to secure credit card data.

- Optimized for both mobile and web to start accepting payments online.

- Provides a buy now, pay later option.

- Braintree has easy third-party integration to increase conversion.

6. Adyen – Pay-as-you-go Online Payment Service

Adyen is an omnichannel commerce tool, that combines data from online and offline sources to gain data insights. For businesses that have in-store sales, Adyen is the best online payment system.

Make payments simple with one platform to accept, process, and settle payments online. Protect your business from fraud with custom products to improve conversion and authorization.

Features of Adyen

- No monthly fees for using Adyen.

- Offers merchant accounts and third-party accounts like contractors, suppliers, etc.

- Integrate digital payment solutions with a plug-in that suits your business to save time.

- Adyen stores all the information in one place to provide easy management of POS solutions.

7. Amazon Pay – Online Wallet-based Payment Processor

One of the popular online payment solutions that facilitate customers having an Amazon account to receive payments through Amazon Pay balance. The payment gateway has around 33 million users as it is optimized for mobile applications making it easy for shoppers to purchase online.

Amazon Pay integrates with eCommerce platforms like WooCommerce, Shopify, and BigCommerce. They provide specific solutions to large-scale businesses with online payment platforms using APIs and SDKs.

Features of Amazon Pay

- Only Amazon account holders can use Amazon Pay.

- Receive payments through multiple payment options.

- Technical and customer support.

- Users can easily purchase using Alexa.

Frequently Asked Questions

-

Are there any fees associated with using online payment services?

Yes. Every online payment service like PayPal, Stripe, Square, and many more charges transaction fees depending upon the features you use. Ensure to check the fees associated with the service you sign up for.

-

Are online payment services safe to use?

Yes, online payments are safe to use. Payment gateways like PayPal and Amazon Pay use SSL encryption, and two-factor authentication to secure transactions made by your users. Ensure your online payment services comply with all the security measures that make your customers feel secure about their information and account data.

What’s the Best Online Payment Gateway for Your Business?

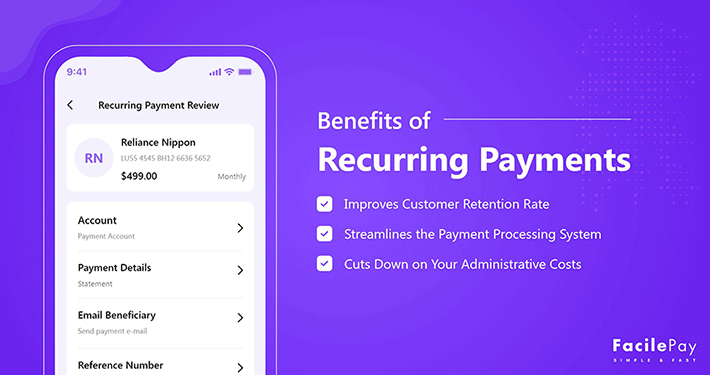

All the above online payment services are the best choice for your customers to pay securely. Decide your budget, and requirements for your business, and select one of the top payment processors to receive quick one-time payment or set recurring billing cycle.

We recommend you to give thorough research before you choose. However, if you have any more suggestions to add, feel free to contact us.