What are recurring payments? How does it help streamline the billing cycle and manage regular payments? Is it safe to use recurring payment processors?

Wait, take a pause. It seems these questions have been bothering you.

Whether a catering business or a pharmacy store, everyone is trying to know the ways recurring payments can help and mitigate business challenges, especially with accounting and payments.

The recurring payments model is a process-driven payment model that has the scope to spur growth, profitability, and success. So, it is a preferred payment method of popular subscription-based businesses like Netflix.

Let’s dive deeper to get a holistic understanding of recurring payments, how they can be used, what myths are associated with it, and what are some do’s and don’ts in this category that you should know.

Contents

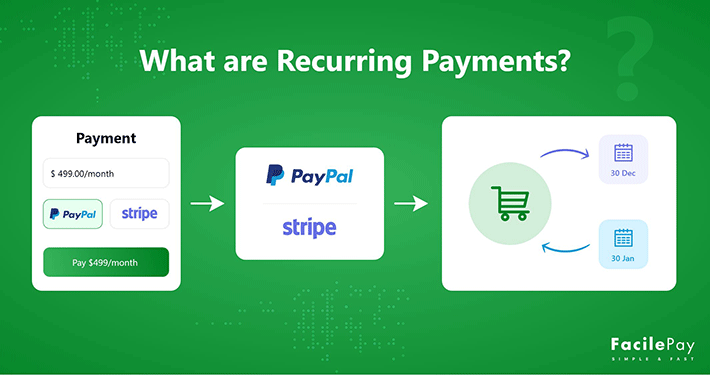

What Are Recurring Payments?

Recurring payments have been around in the market since 2018. But, the payment model really became popular after Netflix and Spotify set their grounds in the market.

The main reason for recurring payments to take over the market is the cost, convenience, and customization.

With recurring payments, revenue collection becomes easier and efficient. If done correctly, the recurring payment system can be a huge time saver for your business. You no longer need to chase your customers for payments or manage the billing process manually. Everything gets automated.

Previously, this payment model was primarily restricted to traditional subscription-based or membership-based businesses like gyms or fitness centers, magazines, and streaming providers.

But now, the scope is getting broader with more industry types entering this model such as:

- Health and wellness services (example: Sleep Cycle, Happify, and Fitbit)

- Education and professional development (example: Codecademy, LinkedIn, and Coursera)

- Home maintenance providers (example: Urban Company, Super, Handy, and Homejoy)

To leverage recurring payments, you need a scalable and efficient software solution to support your business. But, what defines recurring payment and billing software as efficient? What actually is the definition of recurring billing? To understand, let’s take a look at some typical features of recurring billing and payments software.

5 Must-have Features of a Recurring Billing & Payments Software

Are you looking for a billing software that accepts payment in multiple currencies? Or, do you require recurring billing software that can provide advanced revenue insights?

The feature requirement of subscription businesses is going to differ based on the business size, product line, and objectives. But, there are some common features or typical functionalities of recurring payment software that remain constant.

Here are the common features of the best recurring billing softwares:

| Features | Core Benefits |

|---|---|

| Optimized Recurring Billing Cycle |

|

| Accept Payments in Multiple Currencies |

|

| Multi-period Billing for Recurring Payments |

|

| Security & Compliance |

|

| Advanced Reports of Subscription Payment |

|

These above features will enable your business to create billing cycles that are transparent, accessible, and unique for your products and services. Additionally, a recurring payment system with robust recording capabilities will make your accountant’s life easier while automatically tracking your business’s revenue streams.

5 Top Myths About Recurring Payments

The recurring payment method is now a well-established practice for businesses of all sizes around the world. Small, medium, and enterprise businesses are leveraging this payment method to streamline their revenue collection and billing process, reduce exhausting their employees with overwhelming accounting stress, and also increase efficiency and punctuality.

However, there are certain myths floating around it as well. These myths often make companies or businesses put second thoughts on the entire practice.

Here are myths about recurring payments.

-

Myth: Automation is not efficient

Several businesses in the utility sector, food industry, and healthcare domain feel that automation is complex and will not be as efficient as a well-trained professional. For such category of businesses, employees with great accounting training are more efficient in managing finance records and processing payments.

But, this isn’t true.

Humans are bound to make errors, irrespective of the depth of their training, experience, and knowledge. Even the most perfect human, needs a support system to function efficiently.

To dissolve this myth, we have found some supporting data. Here’s what the data says:

28% of companies take 10-15 days to process a single invoice as per IMA (Institute of Management Accountants).

With recurring automation payments, the turnaround time to process an invoice can be minimized (especially when using processors like the FacilePay app that uses Stripe API). You set up the billing once and your job is done. The software you use for a recurring billing will automatically process the invoice for the customer in the specific schedule.

Thus, it is quite evident that the above myth is holding no ground.

-

Myth: Recurring automation is expensive

Do you think that recurring automation is too expensive? If yes, then definitely you need to check the facts before making any conclusions.

Mostly, recurring automation solutions come with a nominal fee charged on every transaction.

For instance, the FacilePay app charges a 1.25% fee on each transaction. With this tiny fee, you can avail multiple benefits like accepting recurring payments at no monthly cost, an easy and secure way to generate online payment links and get paid, receive payment from 135+ currencies, and easy-to-use online invoicing solutions. All of these are for just 1.25%. Does it seem too expensive to you?

In fact, not opting for recurring payments can be costly as you will have to bear the expenses caused due to errors from manual entries, failed transactions, and involuntary churn.

So, what do you prefer?

-

Myth: Automated recurring payments will reduce control over the process

The myth of losing control over the payment process is very common among the skeptics of automatic payments. Interestingly, the opposite of this myth is the actual fact. You gain more control over your revenue generation system with payment automation than without it.

Automatic payments aim to assist businesses by streamlining some tedious and potentially error-causing administrative tasks such as invoicing, maintaining accurate financial records for tax dealings, and accounts reporting.

#FactCheck: Did you know that 39% of consumers pay monthly bills on time with automatic payments?With autopay, you set up the rules and patterns of the system and the software scans them and processes everything as per your set guidelines. Any exception gets flagged and notified, giving you the needed control.

Additionally, automated payment software allows you to easily access past documents and invoices, filter them, and look for patterns, offering a bird’s eye view of your finances.

-

Myth: It takes too long to set up recurring payments

A recurring payment processing software might look complex and seem to take a lot of time to implement or set up, but luckily that’s a myth.

Most recurring payment processing software is easy and quick to install or set up.

For example, processing recurring payments using the FacilePay app is very simple and quick. It even doesn’t require you to be a technical expert to make recurring payments work through the FacilePay app because it uses Stripe API to complete transactions. You will be taken to Stripe’s payment page and complete the transaction when using this app.

-

Myth: There are security risks to recurring payments

When technology, software, applications, and automated fixed recurring payments come into play, businesses often fear data breaches and security risks. However, having complex security protocols in place, those risks are not as grave as you assume.

In fact, manual payment processing holds much more security risks than an automated system. It takes just one human error to make significant damage to your revenue stream.

While automated systems have encryptions and password protections at various levels making them a better solution to use and adapt. Additionally, most softwares with a recurring payment option use gated systems like Stripe or Paypal. Such systems have stringent security and compliance policies in place.

For example – Stripe is encrypted and compliant with the Payment Card Industry Data Security Standards (PCI DSS). All payments through Stripe are secured and safeguarded.

Now, you know the myths related to recurring payment software and have insights into the true facts. When using an efficient recurring payments processor like FacilePay, you don’t have to think twice. You can leverage recurring payments to its maximum and attain growth for your business.

Let’s now explore the top do’s and don’ts of recurring payments for better decision-making.

How to Select Recurring Payment Software for Your Requirements

There are many advantages of using recurring payments for your business. Such as no miss-outs on payment collection, steady cash flow, no billing errors, lower billing and collection costs, and improved customer satisfaction.

Take a look at some of these below “do’s and don’ts” to ensure you get the best experience of using a recurring payment system.

8 Tips to Select Recurring Payment Software

-

Do carefully examine the recurring payments software you choose.

-

Do ensure that the payment processing software has all the features you need.

-

Do examine the billing and collection costs of your payment processor.

-

Do pick a recurring payments tool that accepts all the major methods of payments that your customers prefer.

-

Don’t overlook churn rates with recurring payments.

-

Don’t choose a recurring payment system that needs heavy effort for integration or involves great expense.

-

Don’t neglect recurring revenue reports.

-

Don’t disregard the importance of recurring invoicing in customer retention.

Be on the lookout for a recurring payment processing tool that offers the latest in security and compliance. Make sure your bank account, credit card, and important payment details are safeguarded with standard security and compliance norms such as the Payment Card Industry Data Security Standards (PCI DSS).

Every business has unique needs and requirements that are specific to them. If your business deals with customers in the international markets, make sure that you choose a software or a provider that has the capability to accept multiple currencies.

Closely review and understand the costs that come when you accept payments electronically using recurring billing and payments software. There should be no hidden costs or additional expenses involved.

Customer convenience and satisfaction should always be the core of making any choice, even a payment processing tool. This can do wonders for retaining and returning customers.

A churn rate usually refers to the annual percentage of your customers who typically cease your subscription-based or membership-based service/product. It is important for you to recognize this percentage and get new customers onboarded that surpass those terminating your service/product. Thus, your payment processor must help you track your churn rate.

Similar to every good business decision, ensure you are choosing the best software solution for recurring payments. It shouldn’t be extremely complex. Also, it must not consume huge effort, time, and money to integrate or set up the system.

Never choose a system that doesn’t provide billing and payments reports. Reports on recurring payments and invoicing reveal the true health of your business. It enables you to keep track of your churn rate and also control it. A good recurring billing platform should furnish you with advanced and easy-to-understand reports that help to monitor your business growth.

Recurring billing is widely used among customers because of its convenience. It is easy for customers to have their funds getting withdrawn directly from their bank accounts on scheduled dates for an agreed amount, without interruption. A good software for accepting recurring payments will simplify this process for customers with automated reminders, confirmation emails, and supporting all payment types.

With the above, you must have got a clear idea of the top do’s and don’ts for recurring payments. Let’s now get some of your top queries resolved.

Frequently Asked Questions About Recurring Payments

-

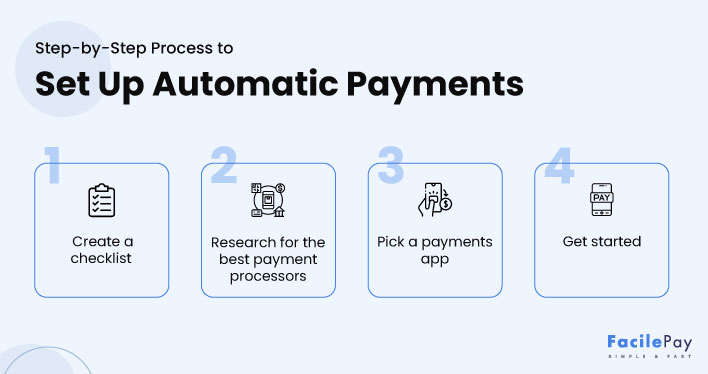

How do recurring payments work?

To process or accept recurring payments, you either need a merchant account or a payment processor. Below are some steps you can follow to set up recurring payments for your business.

- Select the customer you want to bill on a recurring basis

- Select the product/service you want to bill for on an ongoing basis

- Choose the payment method and enter the customer’s payment details

- Choose “make recurring” and enter a name for your template

- Bingo! You are set to start the process

-

What are the benefits of recurring payments?

Recurring payments can be helpful for your business and your customers in multiple ways. Below are some of the recurring payment benefits that you can refer:

- Save time for you and your customers

- Minimize missed payments

- Help business to improve their cash flow

- Help businesses to keep their customers happy and satisfied

- Help reduce churn rate for businesses with optimal tracking

These are some basic benefits that come with this model. There can be more unique advantages specific to a business or customer base.

-

What are the guidelines to be followed for recurring payments?

The mandated guideline to follow is to send reminders to customers before deducting any recurring payment from their bank account. This guideline aims to empower customers to take charge of their own recurring payments and also ensure protection against unrequired subscription payments being set up on their cards.

Ready to Enrol for a Recurring Payment Software?

Recurring payments have been the key growth-driving vertical for businesses today. This blog aims to provide you with a walk-through of all the aspects related to accepting payments on a recurring billing and payments model. The aim is to help you identify checkpoints when moving to a recurring revenue model and finding a payment processor.

If you are looking for an all-in-one solution to accept recurring payments and process recurring billing, you can consider using FacilePay as your payment processor.