Are you a retailer running a grocery store, a fitness studio owner, a streaming service provider, and want to:

- Put your customer’s monthly subscription payments on autopilot?

- Create a scalable billing infrastructure?

- Reduce churn with a secure recurring payment management system?

- Attain efficiency with failed transactions management?

If yes, then you should know what is recurring billing software and how it can help you get the perfect solution to these above challenges.

But first, let’s take a look at some numerical figures regarding subscription industry.

Did you know the subscription industry is expected to see an upward growth trend from $4 Billion in 2020 to $7.8 Billion by 2025? In fact, IMARC Group predicts the market to reach $65 Billion by 2027.

The above data makes it important for subscription businesses to efficiently manage their customers’ recurring payment plans and prices, billing and revenue cycles, and the quote-to-cash process.

Read on this blog to get detailed information about what is recurring billing software, its top features, and its cost.

To begin, let’s start with its definition.

What is Recurring Billing Software? – By Definition

Recurring billing software is a payment model that allows businesses to invoice their customers for a repeated product or service on a specific schedule (monthly, quarterly, and annually). This software is required for billing customers and collecting payments in a way that is efficient.

Every business irrespective of its shape, size, and offerings is now available on a recurring revenue model (subscription-based plan).

From common consumer services like Spotify and Amazon Prime to enterprise-level SaaS offerings like Salesforce or Quickbooks Pro, everything is focused on an installment-based payment plan.

Here is an example demonstrating the success and business growth of a subscription-based business.

There are 209.18 million active paying subscribers on Netflix. The platform generates revenue of $11.455 billion from just the US and Canada. Additionally, it had secured 42% of the total streaming time in March 2020 as compared to its competitors. Isn’t this data great?

Clearly, you can see how Netflix made its mark in the market and skyrocket the popularity of subscription businesses.

A software automating recurring payments for your customers works as a great tool for the success and growth of your business as you can see for Netflix. It wouldn’t be possible for Netflix to see such growth if it has not moved to a recurring payments model and opted for subscription-automating solutions.

Contents

- What is Recurring Billing Software? – By Definition

- Top 4 Best Recurring Billing Software and Their Comparisons

- 12 Key Benefits of the Recurring Billing Software

- What are the Types of Recurring Billing?

- 4 Key Difference Between Recurring Payments and Subscription Billing

- What are the Top Features of a Recurring Billing Software?

- How Much Does it Cost to Get a Recurring Billing Software?

- Frequently Asked Questions

- Want to Automate Your Customer’s Recurring Billing With an Easy-to-use Software?

Now that you have understood what is recurring billing, let us give you 4 top recurring payment software.

Top 4 Best Recurring Billing Software and Their Comparisons

There are many recurring software that provide subscription billing software solutions. But, selecting the right platform depends on the business needs. We have curated a list of top 4 software for recurring billing for customers and businesses to receive easy cash flow.

| Billing Software | What We Picked | Price |

|---|---|---|

|

All-in-one billing solutions for SaaS | Launch: free to $100K Revenue Rise: $249 per month Scale: $549 per month Enterprise: custom |

|

Online subscription billing software | Free Basic: $49 per month Standard: $99 per month Professional: $249 per month Enterprise: custom pricing |

|

Easy integration with multiple payment gateways | Core: $149 per month + 0.9% of revenue Professional: contact for pricing Elite: contact for pricing |

|

All-in-one payment processing and billing system | Small: $15 per month Full: $29 per month PRO: $99 per month |

To get a better understanding of this model, let’s get through the top 12 benefits of using recurring billing software.

12 Key Benefits of the Recurring Billing Software

A recurring billing system or software works out as a technology solution that makes remote recurring billing and payment collection simpler. Here’s how you can get benefitted from recurring billing or invoicing software:

- Manage multiple users and subscriptions of different types (e.g., monthly, bi-monthly, quarterly, and annually) using a single payment gateway.

- Build a scalable solution for payment and collection methods.

- Minimizes the risk of missed or late payments as well as the administrative costs associated with chasing payments.

- Makes finance management and accounting much simpler and less costly.

- Increases customer retention (It is good for building strong and long-term relationships with your customers).

- Better tracking of plan upgrades, downgrades, and cancelations.

- Help recover revenue from customers who involuntarily churned.

- Offers greater flexibility, simplicity, and gratification.

- Promotes positive interactions with customers.

- Gain a 360-degree view of your subscription business through exhaustive reports and ready-to-use dashboards.

- Automates compliance with revenue recognition and global tax laws.

- Increases your ability to earn higher.

As a subscription business, you can only get ahead of the competition when you leverage a good billing solution to its maximum. And, what is a good billing solution? The simpler answer would be – the one that offers flexibility to scale and efficiency to drive growth. You can also simply consider the above-mentioned benefits for a good billing solution.

When referring to these above benefits, you can consider FacilePay (65K users with a 4.2-star rating) as a reliable tool for automated recurring payments. But, what is recurring payment? Check the blog on the meaning of recurring payments.

Now, you know the benefits of using subscription-based billing software in detail and understood the kind of software solution to look for your business. Let’s explore the top features that you should be looking for when choosing a recurring automation billing tool.

With the above benefits, you might have started thinking about recurring billing processing to your business. But, before you move forward, understand the types of recurring billing.

What are the Types of Recurring Billing?

Recurring billing is divided into two categories:

1. Fixed Recurring Billing

In fixed recurring billing the same amount is collected in every payment cycle. Fixed or regular payment is best suitable for businesses that offer services at a fixed rate. For example, newspaper subscription, and gym membership. Fixed business guarantees stable and continuous revenue for the business with upscale prospects.

2. Variable Recurring Billing

In irregular or variable recurring billing, the amount collected might vary in every payment cycle. The payment or the price depends on the customer’s product usage. It is simply a pay-as- you-go process where you need to keep a track of the usage of each cycle.

Variable billing can be further divided into two subcategories:

Metered Billing

This is a system of charging customers based on their service usage. It is also known as usage-based billing like internet and utility services. Typically, a subscription that uses metered billing has a basic plan and the usage calculation is added above the basic plan.

Quantity-based Billing

In this type of variable billing, the customers are billed on the quantity that is agreed upon or purchased by the customer. SaaS providers often charge based on the number of licenses purchased. Similarly, another popular example is volume-based cloud storage services.

Are you confused with the terms recurring and subscription? There is a minor difference between the two. Below are the 4 key points that differentiate the two.

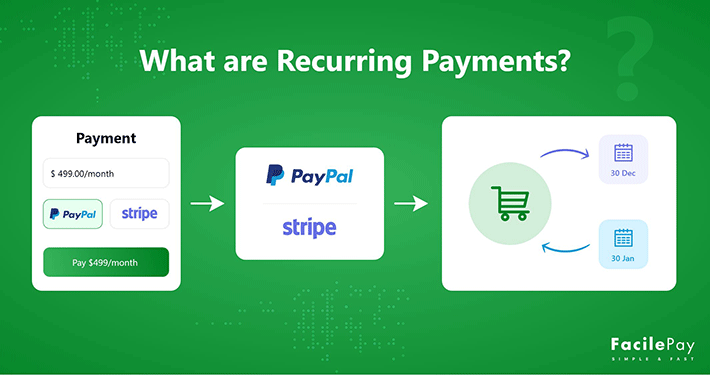

4 Key Difference Between Recurring Payments and Subscription Billing

Recurring Payments and Subscription Billing are similar concepts, but they have 4 key differences.

| Recurring Payments | Subscription Billing |

|---|---|

| Allows customers to make regular, recurring payments for a specific service or product | Allows customers to subscribe to a service or product on a recurring basis, typically with the ability to cancel or modify the subscription |

| Can be used for a variety of products or services, not just subscriptions | Specifically designed for subscription-based products or services |

| May not have as many options for managing or modifying the recurring payments | Typically includes options for managing and modifying the subscription, such as the ability to cancel or change the subscription plan |

| Can be used with a variety of payment methods, such as credit cards or bank transfers | May include additional features such as automatic billing and the ability to offer free trials or discounts |

To know better about recurring billing, you need to know its features. Let’s deep dive into the features of recurring billing.

What are the Top Features of a Recurring Billing Software?

Do you know businesses with a recurring revenue model are growing 5x faster? It is because today’s consumers are preferring to pay for access rather than ownership. This paradigm shift is influencing businesses to turn their one-time sales model into a recurring revenue model. This brings the need for a robust recurring billing platform like Zoho Subscriptions, FreshBooks, ChargeOver, and Pabbly.

A recurring billing platform solves the problem of manual payment detail entries, invoicing, real-time billing plan changes, flexible billing frequency set-ups, failed payment management, and discounts or coupons for existing subscription billing plans.

Here are some of the key features of this kind of software.

-

Automated Payment Reminders & Status Updates

Send automated payment reminders and status updates to your customers before and after the due date of each billing cycle. Set up reminders for both mobiles and emails to regulate and channel your revenue stream and billing process.

-

Invoice Customization

Set auto customization for invoicing changes like upgrades, downgrades, discounts, product or service modifications, and cancellations. You can do this using the proration feature in your recurring billing tool or subscription management software.

-

Expense Tracking

Track your expenses in detail, view and store receipts, and automate advanced reports directly over email. You can also customize the tracking for more insights on your customer behavior using the recurring billing system.

-

Advanced Recurring Invoice Reports

Get an advanced recurring invoice report for all expenses, collections, and future bearings in one standard format. This report should also provide a detailed overview of the failed payments, payment miss-outs, voluntary and involuntary churns, and retried payments.

-

Multi-currency Support

Accept payments in multiple currencies from any location. FacilePay app supports 135+ currencies. You can receive payments in any currency over the FacilePay app if it is supported by Stripe and your bank account.

-

Customer Discounts

Allow customizations in invoicing for products or services with ongoing offers and discounts. You can do this by selecting the percentage off on the particular product or service that you want to apply.

-

Custom Invoice Frequencies

Set custom invoicing frequency with corresponding payment rates for individual customers with different requirements in the billing process. Most subscription billing models consist of monthly, bi-monthly, quarterly, and annual renewal plans. Some also have membership plans. Make sure the subscription billing software can account for these customizations.

These features will help your subscription business to create an invoicing process and billing cycle that is transparent, unique, and accessible for your category of products or services.

Let’s now explore the cost of getting scalable, robust, and efficient recurring billing software.

How Much Does it Cost to Get a Recurring Billing Software?

The cost to get a recurring accounting software varies depending on the type of tool, features, and pricing structure you choose. The pricing depends primarily on some core vital points, such as:

-

Fixed Price: You have to pay fixed charges on each billing cycle.

For example – FacilePay charges a fixed price of 1.25% on each transaction.

-

Add-ons: You can start with a base fee at the beginning and then pay corresponding costs or an additional fee as per your requirements on a weekly/monthly/quarterly/yearly bill.

For Example –

1). Chargify has an essential package of $599 per month with add-ons available for growth and scale plans.

2). Square Invoices has a free package to start with an upgrade option to their plus and premium plans. The plus plan costs around $29+ per month and the premium plan involves custom pricing. This tool also has plans based on the business type.

-

Package Model: You opt for pre-priced packages. It includes paying only for those specific sets of features or services.

For Example – Wave Accounting has a strict package model for different features. Its package plans include invoicing, accounting, banking, payments, payroll, and advisors. While invoicing, accounting and banking are free to access, others are charged either monthly or pay-per-use. The cost ranges from 1%-2.9% per payment transaction to a $329 package.

-

Custom Pricing: You get a custom quote on the basis of the features or services required.

For Example –

1). FreshBooks offers custom pricing solutions to its customers based on individual feature requirements.

2). Zoho provides custom pricing for diverse feature requirements.

Frequently Asked Questions

-

How does recurring billing work?

Recurring billing work in a 3-step process, which includes:

- First, the customer chooses the recurring payments option when they make their product selection to purchase on your website.

- Second, after accepting the terms and conditions and receiving authorization, the customer then provides their payment information and agrees to the amount they will pay.

- In this last and final stage, the merchant starts charging the customer remotely on a yearly, monthly, weekly, or even daily schedule for an agreed-upon amount.

Recurring billing schedules can have an expiration date, or they can be set up to continue indefinitely until the customer makes a change.

-

What is billing software used for?

Billing software makes it easier to manage and maintain repetitive tasks of your finance team with an automated solution. Some of the most basic utilities include:

- Billing Management

- Revenue Management

- Account Management

- Tracking Collections and Identifying Revenue Leaks

- Detailed Revenue Reports

These are some basic billing functionalities. There can be more utilities associated with such softwares but those are unique to business needs or requirements. The above functionalities in recurring billing software form a baseline for many industries.

-

Who can use recurring billing software?

A recurring revenue model is driving growth for diverse businesses and industries as the consumer market is preferring installment-based plans rather than one-time payment methods. Some of the top categories of businesses using this model include:

- Utility Providers: This category includes electricity providers, cooking gas distributors, and mobile network providers. These are some of the common utility services in use on a day-to-day basis. A good example of recurring payments for utility services includes ACI worldwide payment solutions. It works for scheduled auto-payment solutions for US federal taxpayers who are making business tax payments to the IRS (Internal Revenue Service).

- Membership-Based Businesses: Some of the common membership-based businesses using a recurring payments model include gyms, co-working spaces, etc. This includes paying a fixed amount on a recurring basis as membership fees either at monthly or yearly intervals.

- Subscription-Based Businesses: There are many types of businesses that operate using a subscription payment model. Some of them include streaming service providers like Netflix and Amazon Prime, SaaS products like Adobe and WordPress, and food delivery service providers like Zomato and Swiggy.

- Financial Services: This is another industry vertical leveraging the most out of the recurring revenue payment model. An example of a financial services provider includes Bajaj Finserv Ltd. Here customers buy products or services on an EMI plan and the total purchase amount gets divided into small monthly installments that get automatically debited from the salary account on a scheduled date.

These above businesses or industry categories are some common ones that can leverage the most out of a recurring payments model.

Want to Automate Your Customer’s Recurring Billing With an Easy-to-use Software?

The above blog has highlighted the topics of recurring billing software, its top 7 features, its 12 best benefits, and its cost modules. No doubt, it is truly beneficial to have a billing software solution for your business.

FacilePay can be the ideal one-stop solution for you to manage your recurring payments. It will not only be your recurring payments and automated billing tool but work as a POS system to handle hassle-free daily payments through the app.