- A recurring invoice is a type of invoice that is automatically generated and sent to customers on a regular basis.

- Recurring invoices can help businesses save time, improve cash flow, and reduce errors.

- When setting up recurring invoices, consider factors such as payment terms, payment methods, and frequency.

- Use recurring invoices for subscription-based services, memberships, or other recurring transactions to streamline billing processes.

📝Key Takeaways:

Are you a small business owner and finding it difficult to manage subscribers?

Regardless of what industry you belong to, manually creating an invoice and sending it to each subscriber is quite time-consuming. As customers are adopting subscription solutions, incorrect data, missing invoices, and compliance errors can significantly increase the churn rate.

In fact, as per MarketsandMarkets, the global subscription and billing management market size is to reach 7.8 billion by 2025. Below is a screenshot, that shows the rising adoption of subscription business models.

If you have regular incoming payments, then one solution is to set up a recurring invoice to automate this process. Sending recurring invoices minimizes the risk of human error and streamlines your invoicing process.

If you want to know about recurring invoices in-depth, here is a complete guide about recurring invoices for you.

In 8 minutes you will learn:

- What is a recurring invoice?

- What are the advantages of recurring invoices for your business?

- How to create a recurring invoice

- Which are the best recurring invoicing solutions for your business?

- What are the things to consider before starting with a recurring invoice?

Contents

- What is a Recurring Invoice?

- How to Set Up Recurring Invoices in 5 Easy Steps

- 5 Core Benefits of Recurring Invoices for Businesses

- 6 Best Recurring Invoice Solution Providers for Your Business

- What are the Things to Consider Before Starting With a Recurring Invoice?

- What is the Difference Between Recurring Payments and Recurring Invoices?

- Frequently Asked Questions About Recurring Invoices

- Are You Ready to Start Using Recurring Invoices?

What is a Recurring Invoice?

A recurring invoice is a type of invoice that is automatically generated and sent to customers on a regular basis (monthly, weekly, and annually).

Recurring invoice is a useful way:

- For businesses: To streamline their billing processes and ensure timely payment from their customers.

- For customers: To set up automatic payments for recurring invoices, so they don’t have to worry about manually making payments each time the invoice is generated

Let’s understand recurring invoices with an example.

A common example of a recurring invoice is a monthly subscription to a streaming service, such as Netflix or Spotify. In this scenario, the customer agrees to pay a certain amount on a regular basis (e.g. monthly) in exchange for access to the streaming service.

The business then automatically generates and sends a recurring invoice to the customer each month, detailing the amount due and the payment terms. The customer can then use the information on the invoice to make the payment, either by manually entering their payment information or by setting up automatic payments.

Recurring invoices are categorized into two categories. Let’s understand this further.

Which are the Types of Recurring Invoice?

Recurring invoices can be divided into two categories. They are:

- Fixed or Regular Recurring Invoices: In this type of recurring invoice, the business will collect the same amount of money from the customer as per the pre-defined cycle. For example, Netflix will charge the customer the same amount on the same date every month/year

- Variable or Irregular Recurring Invoices: In the variable recurring invoice, the amount collected from the customer will change each cycle. For example, when a customer is billed as per the usage, the amount charged will differ.

Recurring invoices can be useful for businesses that provide services or goods on a subscription basis. This enables businesses to easily bill their recurring customers on a regular schedule without having to manually create and send invoices each time. Now let’s further understand how you can set up recurring invoices for your business.

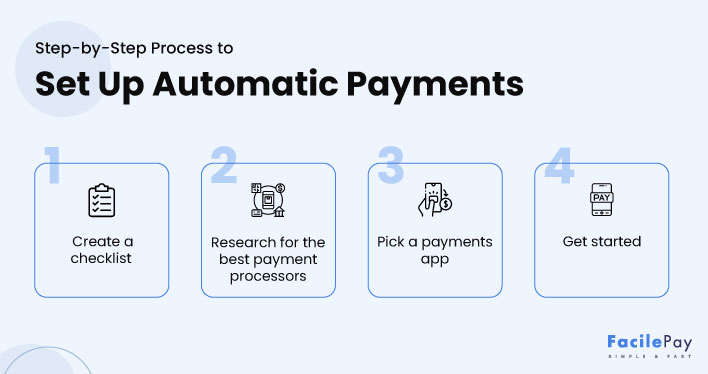

How to Set Up Recurring Invoices in 5 Easy Steps

Here are the 5 steps to set up a recurring invoice for your business.

-

Choose a Billing Software or Tool

The first step in setting up recurring invoices is to choose a billing software or tool that can generate and send the invoices on a regular schedule. There are many different options available, and the right choice will depend on the specific needs of the business. Some common invoicing solutions include Zoho Invoice, FacilePay, Invoice Owl, and Xero. Some of these solutions even provide pre-defined templates. You can select the one as per your requirements.

And if you select FacilePay – one of the payment accepting mobile app which even has a feature of recurring payments and invoicing. This app only charges 1.25% per transaction. In fact, this mobile app has 4+ ratings, 100K+ downloads, and 1.8K reviews on PlayStore. And on the App Store, this mobile app has 4.5 ratings. If you are a small business owner, you must try this app solution.

-

Enter Customer and Invoice Information

Once the billing software or tool has been chosen, the next step is to enter the customer and invoice information into the system. This includes the customer’s name and contact information, the date the invoice is issued, a description of services being billed, the quantity and cost of each item, and the total amount due. It may also be helpful to include any applicable taxes or discounts, as well as the payment terms and instructions for the customer.

-

Set the Recurring Schedule

After the customer and invoice information has been entered, the next step is to set the recurring schedule for the invoices. This helps to know how often the invoices are generated and sent to the customer, such as monthly, quarterly, or annually. The recurring schedule can be set up on a per-customer basis, allowing the business to customize the frequency of invoices for each customer.

-

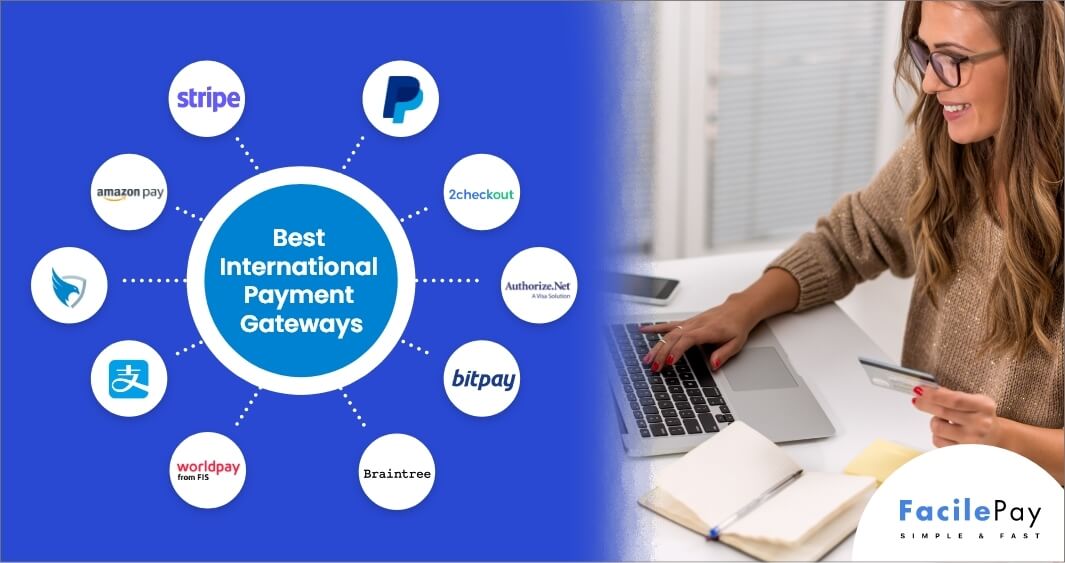

Configure the Payment Processing

If you want to automatically process payments from its customers, the next step is to configure the payment processing settings in the billing software or tool. This will involve setting up a secure payment gateway and specifying the accepted payment methods, such as credit card, bank transfer, or online payment portal. You can even set up automatic payment reminders and overdue payment notifications which ensures timely payment from customers.

-

Test and Verify the Recurring Invoices

Before implementing the recurring invoices, it is important to test and verify that your invoice is working correctly. This can be done by generating a test invoice and verifying that it is sent to the customer on the correct schedule and that the payment processing is working as expected. With this, you can even test the issues of customer-facing features, such as the ability to view and manage invoices online and make payments. This ensures a smooth and seamless experience for you and your customers.

Once these steps have been completed, you are ready to start using recurring invoices to bill its customers.

5 Core Benefits of Recurring Invoices for Businesses

Most businesses provide recurring invoices to their customers. It contains the same invoice details including the customer’s credit card or other details. The customer can add the payment details and ensure a seamless payment process.

Here are 5 core benefits associated with recurring invoices.

Benefit #1: Streamlines the Payment Collection Processes Saving Time

When businesses issue recurring invoices, they don’t need to manually collect payments. At the scheduled date, as per the billing cycle, the amount will be automatically deducted from the customer’s account. And the customer doesn’t have to worry about remembering to make payments on time. This can help to streamline the billing and payment process and can free up time and resources for the business to focus on other important tasks.

For instance: M2i3 prepared its client invoices manually, using Microsoft Excel spreadsheets. All invoice amounts were calculated by hand, including fees and taxes – both provincial and federal. The company uses the recurring invoice feature of Zoho Invoice for support and maintenance. M2i3 sends between two and three invoices – one before the project starts, one at the end of the project, and occasionally one at the project’s midway point. This has streamlined the payment invoice processing which saves time and efforts.

Benefit #2: Improves the Cash Flow

Recurring invoices can help to improve the cash flow of your business. Because the customer has agreed to the recurring billing arrangement, you can expect to receive regular payments on a predictable schedule. This helps you to better manage your finances and ensure that it has a steady flow of income.

Benefit #3: Helps to Build Strong Customer Relationships

By providing a convenient and efficient billing process, you can show your customers that you value their time and want to make the payment process as smooth as possible. This helps to build trust and loyalty with the customer and leads to repeat business and positive word-of-mouth referrals.

Benefit #4: Enhances Professionalism Amongst Customers

Using recurring invoices can help to enhance the professionalism of a business. By providing a consistent and predictable billing process, the business shows its customers that it is organized and reliable. This helps to improve the overall perception of the business in the eyes of its customers.

Benefit #5: Reduces Billing Errors

Recurring invoices can help to reduce billing errors, as the invoices are automatically generated based on the agreed-upon payment schedule. This helps to prevent overcharging or undercharging of customers and can ensure that the business is accurately billing for the goods and services provided.

Overall, these benefits can help a business to operate more efficiently, improve its financial health, and build stronger relationships with its customers. So now, let’s understand which processors you can choose for recurring invoices.

6 Best Recurring Invoice Solution Providers for Your Business

It is very crucial to implement the most suitable payment processor for your recurring invoice requirements. Here we will take you through six recurring invoice solutions that you can plan to include for your recurring payment in small business.

| Logo | Name of Invoice | Google Play & App Store Ratings | Download Link |

|---|---|---|---|

|

Zoho Invoice |

Google Play: 4.7 App Store: 4.8 |

iOS | Android |

|

Quickbooks |

Google Play: 3.9 App Store: 4.7 |

iOS | Android |

|

Invoice Owl |

Google Play: 4.6 App Store: 4.5 |

iOS | Android |

|

Square POS |

Google Play: 4.8 App Store: 4.8 |

iOS | Android |

|

FreshBooks |

Google Play: 4.3 App Store: 4.7 |

iOS | Android |

|

FacilePay |

Google Play: 4.2 App Store: 4.5 |

iOS | Android |

Now you know the top recurring invoicing solution for your business, let’s quickly check the things to consider before using recurring invoicing solutions.

What are the Things to Consider Before Starting With a Recurring Invoice?

There are 4 core things that a business should consider before starting to use recurring invoices:

1. Legal requirements: You should make sure that it is in compliance with all relevant legal requirements for billing and payment. This includes obtaining the customer’s consent to the recurring billing arrangement, as well as clearly disclosing all relevant terms and conditions to your customer.

2. Customer preferences: You should consider the preferences of your customers when setting up recurring invoices. This may include offering different billing frequencies (e.g. monthly, quarterly, annually) and payment options (e.g. credit card, bank transfer, check).

3. Billing and payment systems: You should ensure that it has the necessary billing and payment systems in place to handle recurring invoices. This includes using invoicing software that can automatically generate and send invoices on a regular basis, as well as a payment gateway that securely processes recurring payments from your customers.

4. Communication: You must communicate clearly and transparently with your customers about the recurring billing arrangement. This includes providing detailed information about the terms and conditions, as well as offering customer support to help with any questions or concerns.

Overall, it is important for you to carefully consider these factors before starting to use recurring invoices. This ensures the recurring billing setup is transparent for both the business and the customer. However, after reading about recurring invoices, you might think recurring payments and recurring invoices are similar; but they both are different. Let’s understand how.

What is the Difference Between Recurring Payments and Recurring Invoices?

The main difference between a recurring payment and a recurring invoice is the parties involved in the transaction.

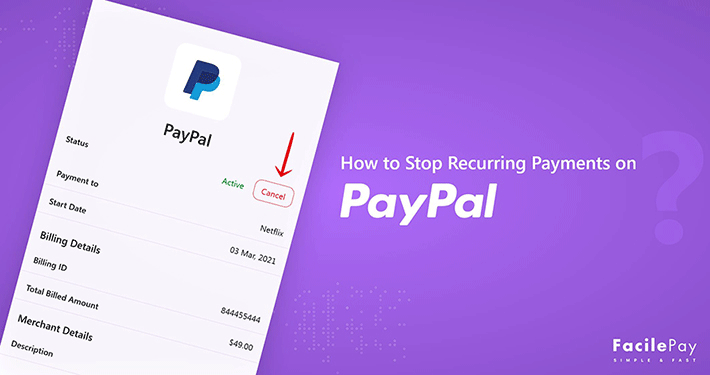

A recurring payment is a payment that is automatically made by a customer on a regular basis, such as monthly or annually. This type of payment is typically used for subscription payment services or for regular payments for ongoing services.

A recurring invoice, on the other hand, is a bill that is automatically generated and sent to a customer on a regular basis. This invoice typically includes details about the goods or services provided, the total amount due, and the payment terms. The customer can then use the information on the recurring invoice to make a recurring payment.

In summary, a recurring payment is made by the customer, while the customer receives a recurring invoice. Both types of transactions involve automatic, regular payments, but they involve different parties and serve different purposes.

Still have questions, let’s understand and frequently ask questions.

Frequently Asked Questions About Recurring Invoices

-

When should you use recurring invoices?

You can opt for recurring invoices, if:

- You need to bill your customers on set repeated intervals

- You have products or service offerings that fit the subscription economy and requires processing recurring charges at repeated intervals

- You set offers for improved customer satisfaction that involves repeated payment cycles

-

Which details are needed to create a recurring invoice?

To create and set up recurring invoices, you need to enter a few basic details in the billing template to get started. Below are the key requirements or invoice details required to set up the billing module for recurring transactions.

- Customer contact information (this includes billing address, contact number, and business email id)

- Your products or services offerings (billing needs to be set as per the chosen subscription services)

- Quantity and price of products/services (to automatically charge customers and raise invoices, the recurring series created for the payment cycle needs to have the correct quantity and cost inputs set. Learn more about what you should charge)

- Invoice frequency (the billing period agreed by the customer for recurring charges is required here)

- Starting date and the number of occurrences (the invoice schedule having the start date and end date needs to be entered here)

-

How much does it cost to set up recurring invoices?

You can set up recurring invoices for free. However, you will be charged for the payments or transactions made using the payment processor. For instance, you need to pay a fee for accepting credit card payments. Similarly, few processors will charge a certain percentage of the transaction to complete the recurring invoice payment.

Once you enter all these details, you are ready with your recurring invoice template structure.

Are You Ready to Start Using Recurring Invoices?

When you start setting up recurring invoices, it may be difficult to start with them. But, once you start sending recurring invoices, you will realize the time and efforts are worth it. The mentioned invoicing solution helps to streamline the recurring invoicing process. And, if you are looking for a reliable and efficient payment accepting solution which even deals with recurring payments and invoicing, consider using FacilePay mobile app.