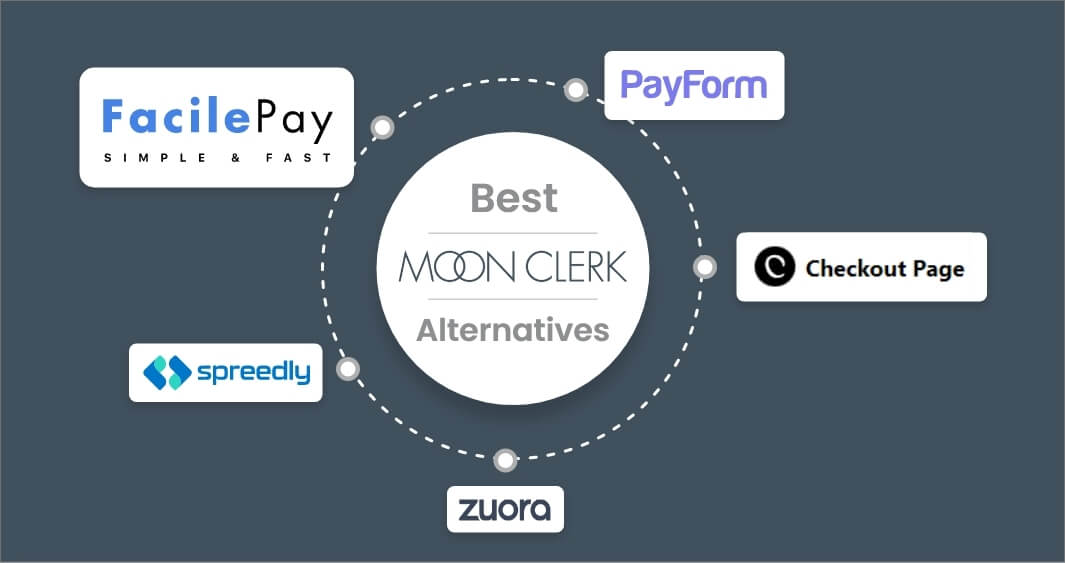

Looking for MoonClerk alternatives? You have landed on the right page.

MoonClerk is not the wrong tool for accepting recurring payments. While it offers a plethora of features that are useful for small businesses and non-profits, it can become a little expensive.

Because MoonClerk charges on monthly volume, once you reach the top tier of $2000 payments, your monthly subscription fee increases. Here’s what a reviewer has written on Capterra:

This feature of MoonClerk may stop your growth and so we decided to help you with MoonClerk alternatives with reasonable pricing structures to easily accept payments.

Contents

Let us study other recurring payment processing tools in detail.

| MoonClerk Alternatives | Rating | Expertise |

|---|---|---|

|

4.7 | Ability to handle multiple payment gateways and support multiple currencies |

|

4.7 | Payment gateway and subscription platform for startups and large enterprises |

|

4.2 | Get customized and readymade templates to create payment forms for any industry |

|

4.0 | Designed to help small and medium businesses with seamless checkout experience |

|

3.9 | Offers automated billing services to subscription-based businesses. |

Here is an in-depth analysis of the above MoonClerk alternatives.

1. Spreedly – Accelerate Growth With a Flexible Payments Strategy

One of the easiest recurring billing payment services to create an enterprise-grade payment stack. Spreedly is one of the payment orchestration platforms built for merchants and merchant aggregators and fintech companies.

What does Spreedly offer?

- Spreedly provides a secure credit card vault to customers and helps them maintain PCI compliance with easy payment data security.

- Provides integrations to hundreds of payment gateway and third-party APIS.

- Spreedly offers rapid development to help businesses add new partners, customers, and markets.

Features of Spreedly

According to G2, Spreedly scores highest with the following features:

- Provide the best payment experience with an easy and quick payment gateway setup for Stripe billing, Apple pay, etc. to avoid failed payments.

- PCI-compliant and payment infrastructure designed specifically to attract more customers.

Let us understand the pros and cons of Spreedly.

- Spreedly allows easy integration with a variety of online payment services, which can save time and money for businesses.

- There is a wide range of security features, such as encryption to help protect the sensitive data of the customers.

- This platform is highly customizable and allows businesses to customize payment forms and recurring billing systems for unlimited products.

- Spreedly is a paid service and the starting price of the subscription management might take a toll on the businesses.

- Requires additional resources to set up and navigate complex recurring payments.

- This platform may not be the best choice for businesses who are specific with their payment processing needs as they do not offer all features and integrated payment links.

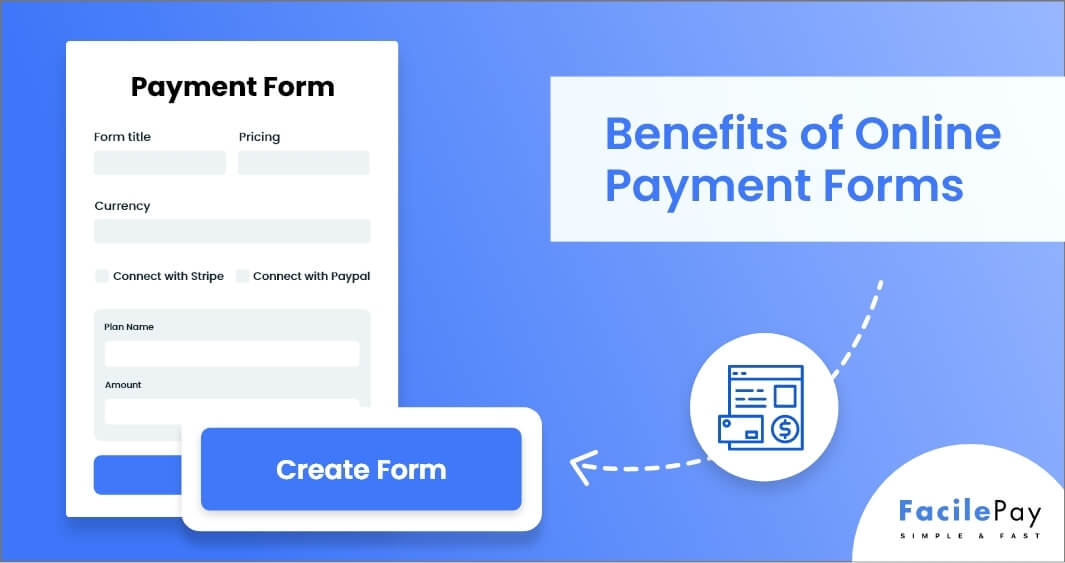

2. PayForm – Process Recurring Payments Now

The most common and one of the best MoonClerk alternatives is Payform. A simple way to implement subscription payment processing in your business is to develop a customized solution for your use case. This has several limitations like having to achieve PCI compliance yourself.

The second option is to use readymade templates to create forms and solutions like the Stripe payment platform. Integrating this payment alternative requires a code. However, there are no code solutions that allow you to integrate the payments process for recurring easily like PayForm.

3 Key Features of PayForm

- Flexible forms connected to a recurring billing system for payment processing. You can choose a dozen templates to create quick forms to convert sales.

- With customized forms, you can add or remove fields or embed a fully customized checkout experience.

- With 256-bit SSL encryption and secure gateways like Stripe, PayForm allows the processing of payments securely.

- Supports more than 50 currencies and 30 languages to sell services globally.

- Does not need a credit card to sign up.

- User-friendly interface that helps businesses of all sizes to create and manage payment forms.

- The sign-up process is a little deceiving.

- Once you sign in the app is connected to a Stripe account that prompts you to input the credit card information.

- There is no pop-up checkout or dunning management

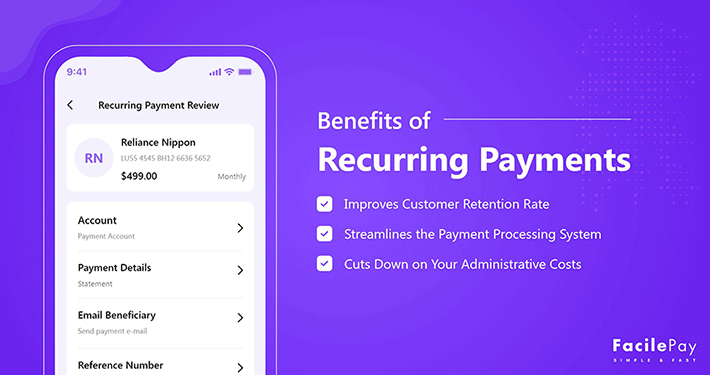

3. FacilePay- Accept Payment from Anywhere

FacilePay is one of the best payment forms providers for recurring and one-time payment services. Accept payments with FacilePay forms to manage monthly and yearly subscriptions.

You need not regularly send payment process request reminders to your customers on a daily basis. Small businesses and startups can avail of these services and create appealing payment forms or use readymade templates as per business needs. Let us understand a few features of FacilePay with the pricing structure.

You can use FacilePay if you are

- A small business and looking for an easy solution to accept online payments to streamline subscription management.

- Create payment forms in just a few clicks and less transaction fees

- Looking to track subscriptions and receive payments under one platform with management software.

Features of FacilePay

- Accept recurring and one-time payments from a single platform.

- A multi-currency billing support system.

- Hassle-free billing and subscription management software.

- Embed shareable payment link.

Let us understand the pros and cons of using FacilePay.

- FacilePay forms are easy to create and use for accepting quick payments from your customers with no complex setup.

- Gain real-time insights on recurring billing revenue and manage subscription business.

- FacilePay helps you to accept payments in any payment method such as automated clearing houses (ACH), credit and debit cards, and online payments.

- Free signup to the payment platform.

- You can accept payments only via PayPal and Stripe.

Note: If you are looking for simple ways to understand accepting payments online, read our blog on – how to accept payments online.

4. Checkout Page- Embed Single-page Checkout Seamlessly

One of the best web pages that allow online payment processing to businesses with easy customization for products and services. It typically includes fields for users to enter the payment information such as credit card details or merchant account information.

Checkout Page is essential for recurring billing or subscription management software to enable customers to set up automatic payments on a single page. Let us check the unique features of the Checkout Page.

5 Key Features of Checkout Page for Online Payments

- Easy customization to match the branding and design of the business. Customers can easily recognize and trust the process.

- Recurring payments are optimized through mobile devices to ensure customers experience a hassle-free payment process on the go.

- Built-in security features such as SSL encryption, and fraud detection to protect the customer’s data.

- Checkout Page is one of the MoonClerk alternatives that gives multi-currency support to reach a wider audience worldwide.

- Quick integration with multiple payment gateways making it simple for businesses to accept recurring payments.

- Checkout Page allows businesses to track recurring billing with subscription management software. This improves business efficiency and the accuracy of customers’ information.

- Enables businesses to offer different plans and recurring billing options to accommodate customers’ needs and preferences.

- Any business needs to increase customer retention and Checkout Page helps to maintain timely subscriptions and manage their payment processing seamlessly.

- Checkout Page is a little expensive for small businesses as they charge on the number of transactions processed.

- The subscription management tool may require a certain level of expertise to set up and maintain. It increases the investment to hire resources.

- The Checkout Page is not user-friendly if the setup is not as per the customer’s needs resulting in a high abandonment rate.

5. Zuora – One of the Best Alternatives to One-time Billing

One of the top recurring billing and payment platforms that offers a wide range of features to provide users with a better payment experience. You can use this platform as a growth enabler and recurring generator for small and large businesses.

Zuora helps to increase the cash flow, and minimize the churn rate that acquires new customers. The monetization platform for any business model unlocks new opportunities and automated complex revenue systems. The world’s most innovative companies like Ford, Microsoft, Sony, and Zoom have used Zuora to build, run and grow.

4 Key Features of Zuora Subscription Management

- Payment Plans for any Charge Model: Charges to use Zuora are as per the usage. The platform allows you to leverage the pricing plans that decide the payment options based on the user’s intent and business requirements.

- Integrated Ecosystem: Easily integrate your form with the ecosystem. Zuora provides a low-code SDK and API integration that works quickly with your current payment pages.

- Centralized Payment Operations: You can centralize the entire payment processing and expense management with an automated workflow. Ensure seamless experience to the customer portal and a hassle-free view of the monthly revenue.

- Omnichannel Purchase: Provide unified subscription business by getting orders from multiple channels such as quoting, website, and other service partners. Combine subscriptions and one-time payment requests in a single order or line of items through Zuora.

Let us understand the pros and cons of using Zuora.

- Zuora is flexible and can handle multiple billing options including one-time, and recurring billing.

- Zuora helps businesses to customize billing and monetization models as per their user’s requirements and businesses.

- With centralized online payments, you can remove the manual payment process that goes into payment management reducing the cost and time.

- The platform is not user-friendly and nor does it help to customize forms. You will need a tech expert to help with the required changes.

- The platform has plenty of features that may not require for all types of businesses and so it becomes difficult to purchase complex plans.

- It is not easy to manage the split revenue if Zuora is combined with other tools for seamless finance management

Frequently Asked Questions

-

Is there a cheaper alternative to MoonClerk?

There are some alternatives like FacilePay that give a low pricing structure and also a 7-day free trial to the businesses initially. It’s best to compare the pricing structure and choose the best plan as per your business needs.

-

Can I integrate another platform with my website?

Yes. There are many recurring billing platforms that allow integration to websites with website builders like Shopify, Salesforce, WordPress, etc.

-

Does another platform offer more customization options than MoonClerk?

There are various platforms that give customization. However, FacilePay is the best recurring payment platform that helps you create a customized form to accept payments from your customers. It’s best to checkout the features of different platforms and find the best suitable for your business.

Choose the Best Payment Form Builder

After you read all the comparisons between the above 5 alternatives to MoonClerk recurring payments, pick the best for your subscription management and recurring billing business.

Every platform has its own pros and cons and you need to choose which one is the best for your business needs. Providing the best payment options to your customer portal will help you gain more customers and increase the retention rate. Offer them the best payment experience to avail the purchase of more products and services.