Are you looking for ways to stop recurring payments from your debit card?

You have landed on the right blog.

Learn how to stop recurring payments on debit card through this blog as the bank provides multiple ways.

In this article, you will learn:

- What are recurring payments and how to use?

- What are the ways to stop automatic payments on debit card?

So, let’s get started.

Contents

What are Recurring Payments?

As its name suggests, recurring payments refer to periodic regular payments taking place when customers make purchases from merchants against good or service usage.

Generally, recurring payments also referred to as automatic payments are set up using a bank account, debit card, or credit card on duration like monthly, weekly, daily, or annually.

It means you allow an organization or company to take payment from your debit card on a regular basis against the services you opt for.

Example:

If you have purchased a subscription to a Netflix account, then on the scheduled date of every month or year, a fixed amount is debited from your debit or credit card.

Setting up automatic payments is really easy. You just need to visit the vendor’s site to make a subscription purchase. Add your account, enter debit/credit card details, and that’s all.

But, are looking for steps to cancel recurring payments subscribed through the debit card?

We have the solution for you. Below are the different ways to stop a debit card payment.

7 Ways to Stop Recurring Payments on Debit Card

The process to stop automatic payments from a debit card or your checking account is simple. Mostly, you can cancel automatic payments online and if not possible to do it online, you can do it offline.

First of all, the first place to stop automatic bill payment is to check your online banking services and update it accordingly once you have spoken to your biller.

Here are the 7 ways to stop your next scheduled payment or future payments from a debit card.

-

Cancel Subscription Services to Stop Automatic Payments

- Log in to your subscription service provider account

- Go to the settings dashboard and find the manage subscription tab

- Click on the tab to cancel the subscription plan

- Confirm the cancel subscription option

-

Cancel Future Payment on Debit Card Through Bank’s Customer Service

If you are looking for stopping automatic payments offline, you need to contact your bank. You can get in touch with the customer support of the bank. Then, you can ask them to stop recurring payments on your card. Further, the bank will process your request and stop the recurring payments from your bank account.

-

Stop Recurring Payments Through Online Banking

Cancel your next automatic payment online using online banking services. Most financial institutions allow to manage and cancel automatic payments within their apps without any hassle.

-

Issue Bank a Stop Payment Order

Stop payment order is a method through which you inform the card issuer to stop the scheduled payment for a particular merchant. So, banks no longer allow a merchant to automatically take payments from your debit card even if you have not submitted a request for revoked authorization.

-

Stop an Automatic Payment by Emailing the Vendor

Stop automatic withdrawals by emailing or calling the vendor from which you are purchasing the services. Contact the merchant’s customer support by phone and ask the support team to immediately stop your recurring bills as you no longer want their services. You can email customer support to stop your automatic billing against the services that you want to discontinue.

-

Issue Revoke Authorization Against Your Automatic Payment

When you want to stop your recurring payments, one of the most reliable ways is to contact the merchant that is authorized to withdraw automatic payments. Give the merchant the notice of revoking authorization for your future payments.

If none of these methods works, then you still have a method that you can use to stop your recurring payments from your debit or credit cards permanently.

-

Submit a Complaint to the Financial Consumer Agency of Canada

Neither your bank nor merchant does not take any action after receiving your revoking authorization on your request. The last option you have is to submit a complaint to the Financial Consumer Agency of Canada. The agency will look after your stopping recurring payments.

Generally, if any unauthorized payments get debited from your debit cards, in such cases, this financial agency of Canada helps you to get your money back. You can even cancel recurring payments from PayPal. Want to know how? Check this blog about how to discontinue recurring payments on PayPal.

You need to opt out or stop the subscription services to which you have opt-in. For example, if you have a subscription to Netflix that costs you $X monthly, then you can easily cancel the subscription from the mobile app or websites where you have made the purchases. Here is the general process that you can follow to cancel your subscription services.

Why Use Recurring Payments?

This concept of automatic payments came into existence to reduce the load of remembering the regular recurring pay dates. Here are some benefits of using recurring payments.

- Decrease the late payments

- Saves time and effort for making payments manually

- Avoid getting late charges for being unable to make on due dates

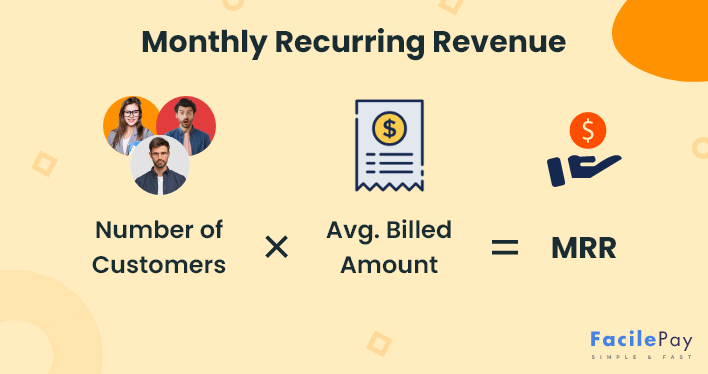

When you set up an automatic payment, it works as, set and forget it. This also helps you to track the expenses you do monthly as you are easily able to track the payments. In fact monthly recurring revenue helps to forecast the revenue earned in that particular month. To understand in detail about what is monthly recurring revenue, you have our blog to read.

Being a business owner, if you are planning to use a mobile to accept Stripe payments within an app, then FacilePay can help you. This app will help you to set up recurring payments for your business with ease.

Which are the Different Types of Recurring Payments?

There are majorly two types of recurring payment methods. First, regular or fixed recurring payments, and second, irregular or variable payments.

Check the following table to know the difference.

| Fixed Recurring Payments | Irregular Recurring Payments |

|---|---|

| Fixed recurring payments are the charged with same amount every time on a decided duration of time. The duration can be monthly, weekly, daily, or annually. | The irregular recurring payments are charged based on the customer’s usage of the product or service. |

| For example: If you buy a gym membership or magazine subscription and set an auto-pay, then you get charged monthly from your debit card. | For example: The electricity bills vary from month to month so the payment defers. Another one is grocery bills which defers from month to month and so do its payments. |

So these are the steps that help you to stop automatic payments from banks or credit unions. If you still have any questions about the automatic recurring bills or payments, check the following sections that include the frequently asked questions.

Frequently Asked Questions

-

Why would customers need automatic payments?

Using automatic payments allows customers to get free from the headache of remembering the payments month after month.

-

What is the difference between autopay and recurring payments?

A recurring payment or autopay refers to the withdrawal of money from your bank account or credit/debit cards against the decided billing cycle. Whereas, the scheduled payments are specific or individual payments scheduled on a specific date prior to a bill date.

-

Can bank stop automatic payments?

Yes, banks can stop payments in a convenient way as you just need to provide them “stop payment order”. Even if you have not given the revoke authorization to the merchant.

Stop Your Recurring Payments Without Hassle

Knowing how to stop your recurring payments is important to manage your personal finance.

Regardless of the method that is used for further payments, you must know how to stop your recurring payments. However, whichever method you have used to stop your future online payments. You must monitor your expenses and payments that are withdrawn from your accounts to avoid any future issues and to know the payments are stopped.

Following the above steps surely helps you to revoke authorization from your automatic debits or future payment orders.