Does your business have fluctuating revenues?

Want to know if your overall revenue is growing or declining?

If yes, you have landed on the right blog. You can overcome the above challenges by calculating your company’s MRR.

But, what is monthly recurring revenue?

MRR tells your company’s current financial health and helps you forecast future revenue helping you to take better financial and business decisions.

You will get a detailed understanding on MRR from this blog.

In just next 15-20 minutes, you will learn about:

- What is monthly recurring revenue?

- How do you calculate MRR?

- Which are the types of MRR?

- What is the importance of MRR?

- What mistakes to avoid while calculating MRR?

So, what are you waiting for? Let’s dive right in.

Contents

- What is Monthly Recurring Revenue (MRR)?

- How to Calculate MRR

- Which are the types of MRR?

- Benefits of Calculating and Understanding MRR for Your Business

- Avoid These 6 Common Mistakes When Calculating MRR

- How to Increase Your Monthly Recurring Revenue [3 Easy Ways]

- FAQ About Monthly Recurring Revenue

- Set Your Monthly Recurring Revenue Easily

What is Monthly Recurring Revenue (MRR)?

Monthly Recurring Revenue (MRR) is the stable income your company expects to generate in any given month. Usually, companies with subscription business models use MRR.

You generate recurring revenue when customers’ payments of recurring nature are automatically renewed as per monthly/ annual contracts or subscriptions.

For example, OTT platforms like Netflix rely on the subscription model and use the MRR as a key financial indicator.

Let’s now understand the MRR calculation.

How to Calculate MRR

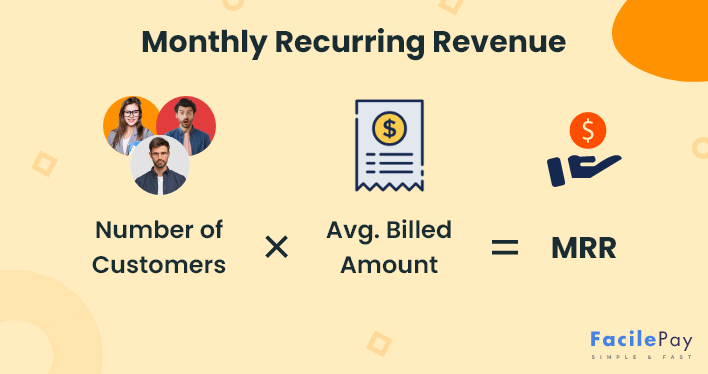

To calculate Monthly Recurring Revenue, you need the following MRR formula:

- The average monthly revenue per user (ARPU)

- The total number of subscribers using the monthly plan

The formula for ARPU is:

So, the formula for calculating Monthly Recurring Revenue (MRR) is:

If you have subscribers with annual plans, divide the yearly cost of the plan by 12 before multiplying it with the total number of annual subscriptions

Let’s understand this with an example:

Say, you have 10 monthly subscribers who pay $100 per month. So, your MRR becomes $1000 per month.

Now, if you’ve 2 customers with an annual plan (Annual Recurring Revenue) of $1000. So, by dividing the plan price by 12 months, we get $83. Therefore, our second MRR for the annual customers pay becomes $163 ($83*2).

Finally, adding both MRRs, we get the total MRR of $1163.

How to Calculate the Net New MRR?

As your business grows, it will become important to track not on the top level MRR but the factors that make up the new MRR. There are three elements that calculate the net MRR.

- New MRR – Additional MRR from new subscriptions

- Expansion MRR – Additional MRR from existing customers or upgraded customers

- Churned MRR – Monthly recurring revenue lost from cancellations

- Net New MRR = New MRR + Expansion MRR – Churned MRR

If the churn rate of MRR is higher than the new and expansion MRR, you are losing the monthly revenue of that month.

Now, as your business expands, you will come across different types of MRRs. We cover these MRRs below in detail.

Which are the Types of MRR?

Here are the eight different types of Monthly Recurring Revenue for better performance of SaaS companies.

-

New MRR – Revenue Gained from New Customers

-

Expansion MRR – Additional MRR Revenue Gained from Existing Customers

-

Upselling

In a subscription-based business model, upselling is when existing customers move to a more premium plan. It also includes customers who moved from a free plan to a paid one.

-

Cross-selling

With cross-selling, the existing customers buy other associated products or services from you. For example, when Amazon Prime video members buy or rent movies on its platform, Amazon monthly revenue increases. This contributes to the expansion Monthly Recurring Revenue (MRR).

-

Reactivations

The subscription revenue you collect from existing customers who decided for subscription cancellations but reactivate their monthly subscriptions contribute to expansion MRR growth.

-

Add-ons

Recurring add-ons or extra perks are also a part of the expansion Monthly Recurring Revenue (MRR).

-

Contraction MRR – Total Reduction in Revenue

- Customers downgrade because they cannot find value in the premium packages

- It could also mean a large number of your existing customers have redeemed a special discount coupon

-

Downgrade MRR – Reduction in Revenue from Existing Customers

-

Upgrade MRR – Revenue Generated When Subscriptions are Upgraded to Higher Plans

-

Reactivation MRR- Revenue Earned from Previously Canceled Subscriptions

- Better offer than competitors

A rising reactivation MRR shows that customers that went to your competitors are returning. Your customers tried different services but realized that you offered the most value.

- Marketing campaigns

A good reactivation MRR might also mean that your marketing team is working wonders and is successfully bringing back old customers. However, if you are offering deep discounts, it might affect your contraction MRR. Continuously using heavy discounts will affect your subscription businesses’ financial health in the long run.

-

Churn MRR – Measure of Lost Revenue Month After Month

-

Net New MRR – Increase/Decrease in Revenue from One Month to the Next

New MRR is the amount of recurring revenue you generate from new customers added during that month. New monthly recurring revenue (MRR) indicates the financial health and growth of your company.

Your marketing department can use this metric for tracking performance to better understand your marketing campaigns. Compare your new monthly recurring revenue (MRR) with customer acquisition cost (CAC) to measure your spending efficiency.

The formula is the same as MRR. But instead of total subscribers, you only count the new users added during the month.

Expansion MRR is the extra revenue you generate from existing customers in a given month compared to the previous month. Positive expansion MRR shows that you were able to retain your customers. This is great for you as no customer acquisition cost (CAC) is involved in these sales.

There are four different ways to generate additional revenue (or monthly payments) from existing customers on a monthly basis:

Expansion MRR shows how satisfied your customers are with your offerings. As their satisfaction levels increase, so does their customer lifetime value (CLV).

Contraction MRR refers to the loss you incur when a customer cancels or downgrades their subscriptions. In short, it shows the negative change in revenue due to churned customers in subscription-based businesses.

Contraction MRR also includes the loss you bear when customers avail of discount codes or remove add-ons and perks.

Like expansion MRR, contraction MRR also shows how well you maintain the customer retention rate. The lower the contraction MRR on a monthly basis, the higher the retention.

If you’re facing a high contraction MRR, it may be due to these reasons:

It’s inevitable to have some churned customers. But you can minimize contraction MRR by understanding your customer’s needs and addressing their feedback. Also, try to add more perks and features in the premium packages to make them more valuable for the users.

A downgrade MRR is recurring revenue lost compared to the previous month. Unlike contraction MRR, downgrade MRR only measures the drop in revenue when customers exchange the premium packages for the cheaper ones. To avoid downgrade MRR, try adding perks and value to the top-tier service bundles. You might also have to consider changing the price of the products to suit the needs of your customer base.

Opposite to downgrading MRR, upgrading MRR is an increase in your income when customers upgrade—move to high-cost subscription plans during the month. Some businesses also consider the add-ons and extra paid features as a part of the upgrade MRR.

Constantly increasing upgrade MRR signifies a happy customer base. It means that your product is scaling, and you have found the perfect balance between the cost and service offerings. You must monitor your sustainable growth consistently and make minor tweaks to maintain customer satisfaction.

However, if your upgrade MRR has plateaued, you are offering too much value in your low-tier plans. As a result, your customers are not finding a convincing reason to upgrade to the better versions.

Reactivation MRR is the recurring revenue generated from customers who had churned but reactivated their accounts during the current month. However, don’t consider free-trial customers opting for paid versions of your software in the reactivation MRR.

Overall, reactivation MRR is a positive metric. Here’s what results in high reactivation monthly recurring revenue:

Churn MRR stands for the total loss of potential income due to cancellations and deactivations during the month. Churned MRR is a crucial metric for the software development team. They have to constantly update and optimize the app based on user feedback to arrest churn. Of course, the ideal target is to reduce churn MRR to $0, but some churn MRR is inevitable.

The churned MRR metric helps the finance and operations department to build a better revenue prediction model for the following months. Consistently tracking the churn rate will make it easier for you to forecast your burn rate, profit, and loss.

Net MRR is net growth or shrinkage in your MRR during the month. To calculate Net New MRR, subtract the sum of a downgrade, churn, and contraction MRR from the sum of regular, expansion, upgrade, and reactivation MRR.

Net New MRR combines all the others mentioned on the list to represent your company’s growth.

A negative Net New MRR shows you have lost revenue, while a positive Net New MRR shows you have gained revenue. Net New MRR is negative when the sum of your new MRR and expansion MRR is less than the Churn MRR.

Now that we understand the different types of MRR, let’s move on to understanding why MRR is critical for your business.

Benefits of Calculating and Understanding MRR for Your Business

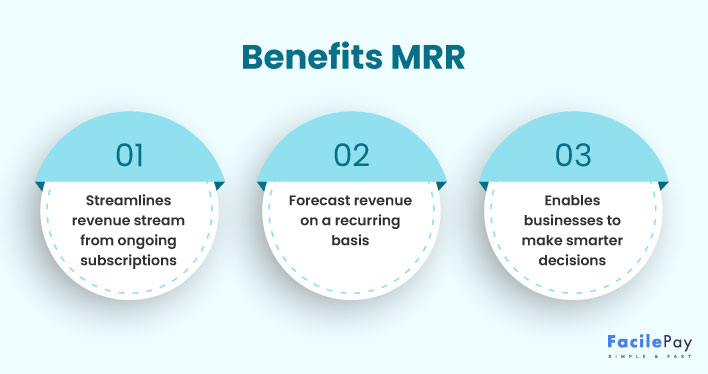

MRR is critical to understanding your company’s financial health and making better business decisions. Here are more reasons why it’s essential to calculate MRR:

-

Revenue Forecast to Estimate Future Revenue

-

Performance Tracking to Make Effective Decisions

-

Budgeting for Creating a Plan to Spend Your Money

MRR is widely used to forecast a company’s short-term and long-term revenue.

A thorough analysis of MRR helps you find income patterns, which you can use to predict income generation for the upcoming months. Your sales team can highlight the areas where you must put more effort to get better financial results. Also, your sales team can then prepare strategies for predictable revenue.

A SaaS business generates income in small monthly installments. As a result, tracking MRR helps you track your sales performance. MRR and its components help you track monthly trends and offer valuable insights. You can set MRR benchmarks to attain your growth and sales goals. The MRR trend graph also helps you identify your best months and craft seasonal strategies.

Lastly, as MRR predicts the inward cash flow for the next month, you get a brief idea about the amount of capital you will have at your disposal. This crucial information helps you with resource management and reinvestments. These projections are consistent and reliable and can help with the expansion of business. In addition, the different versions of MRR helps you find areas where you can cut back on expenses.

For example, if your New MRR has increased along with the contraction MRR, it’s safe to assume that new customers are taking subscriptions using discount coupons. But if the downgrade MRR increases in the next month, you can assume that the customer is not finding value at the original prices. Therefore, allocating more resources to balance these prices will help you attract more customers.

But note that MRR can only help you with all of that if you avoid making the common mistakes listed below.

Avoid These 6 Common Mistakes When Calculating MRR

There are some common mistakes businesses repeatedly make, even though most subscription-based companies have started relying on MRR. Let’s address the top ones:

Mistake 1. Using Non-recurring Revenue for Payments

Including non-recurring revenue in one time payment or subscription calculations is one of the top mistakes. In such cases, you’ll see inflated and misleading MRR figures. One-time setup fees or hardware expenses are not a part of recurring revenue. Therefore, before fully relying on the model, carefully outline which expenses are recurring and non-recurring

Mistake 2. Using Incorrect Billing Intervals for Delayed Payments

Monthly customer payments are the most common method of billing, followed by annual, quarterly, and weekly. Hence, using the price plan for a different time interval is another big mistake. One way to rectify this is to convert all prices to monthly prices during the MRR calculation.

Mistake 3. Including Trial Period Users to Achieve a Key Outcome

Do not include trial period users in your MRR calculation simply because they are not contributing to the total revenue yet. Including them will cause errors in your MRR and make it difficult to create better strategies. Yes, you can include them the moment they start paying you monthly. However, your customers can easily deactivate recurring payment service from debit card, if you use a trial period.

Mistake 4. Using MRR as an Accounting Figure

MRR is a business metric and not an accounting figure. You cannot use your MRR figures to get tax breaks and manipulate your company’s annual reports. MRR only measures the growth rate of the company.

Mistake 5. Not using the various types of MRR

There are various types of MRR. Each type is important for a different aspect of the business. It is important to understand the different types and use them to display a balanced image of MRR.

Mistake 6. Not Excluding Discounts

You must subtract the discount coupons from the total MRR for transparency. Discounts and coupon codes generally come under the contraction MRR. But you can also directly subtract them from the gross MRR.

Avoiding these top mistakes will set you up for success. When you finally have the correct MRR figure, you can move on to increasing your monthly recurring revenue.

How to Increase Your Monthly Recurring Revenue [3 Easy Ways]

Here are the top 3 proven ways to increase your Monthly Recurring Revenue:

-

Upselling and Cross-selling

-

Increase Your Prices

-

Limit the Free Trial period

This way of adding to your existing customer is to increase your MRR. With upselling, you can increase the current recurring revenue stream. On the other hand, cross-selling enables you to establish a new revenue generation stream.

If you market it correctly, customers will be more than willing to pick up a few add-ons or new features. After all, they won’t mind spending a bit extra if they find value in your products. Try not to overdo it with the upselling tactics, as it might turn away long-time customers.

But, what if you are a non-profit organization? Do you want to increase your MRR or donation for your organization? If yes, check this guide that helps you in making recurring donations using Sqaurespace.

This might sound a bit obvious, but one of the top ways to increase your MRR is to just tweak your pricing plans to increase your prices. To stay competitive, most companies are underpricing their products. Such companies are incurring losses in exchange for a larger customer base.

But note that suddenly changing your pricing plans and increasing your prices might make customers search for different providers. You have to adopt smart strategies while increasing the prices. Increasing the prices over multiple quarters is advisable to make it less noticeable.

If you offer all your great functions in the free version of your app, you are discouraging customers from shifting to the paid version. The free versions of your software or app should only give them a sneak peek and motivate them to buy the paid version. Therefore, limit the trial period even if you offer more functionality in the free version. Doing so will help you increase your MRR.

Got more questions? We’ve got you covered.

FAQ About Monthly Recurring Revenue

-

What is an MRR analysis?

MRR analysis is the calculation of all the different variations of MRR and comparing it with other key metrics like CAC, CLV, etc.

-

Which businesses have recurring revenue?

The recurring revenue model is most visible in content-based companies. In this model, the platforms provide access to exclusive content and an ads-free browsing experience in exchange for a monthly subscription. Netflix, Spotify, and HBO are top examples.

-

What is non-recurring revenue?

Non-recurring revenue refers to the one-off payments that may not happen in the future. For example, if your SaaS company conducts a webinar and 100 people buy tickets, this is non-recurring revenue. Because such events may not happen in the future, and even if they do, people may not return.

Set Your Monthly Recurring Revenue Easily

MRR is a key metric that offers valuable information about the company’s financial situation, especially for a SaaS business. During the early stages of such businesses, stakeholders value MRR more than the profit and loss statements. If your company regularly analyzes its MRR, takes action, and has secured its revenue stream, it won’t take long for you to become a profitable and successful business. Revenue growth, thus, will be inevitable.